Provincial and Territorial Energy Profiles – Canada

On this page:

Connect/Contact Us

Please send comments, questions, or suggestions to

energy-energie@cer-rec.gc.ca

-

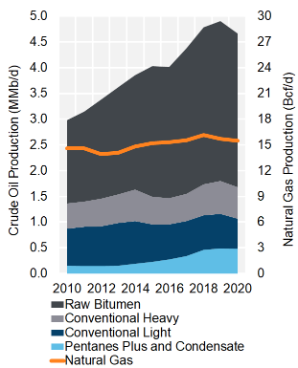

Figure 1: Hydrocarbon Production

Source and Description:

Source:

CER – Estimated Production of Canadian Crude Oil and Equivalent and Marketable Natural Gas Production in CanadaDescription:

This graph shows hydrocarbon production in Canada from 2013 to 2023. Over this period, crude oil production grew from 3.6 MMb/d to 5.1 MMb/d, with almost all growth coming from the oil sands. Natural gas production increased from 14.1 Bcf/d to 17.9 Bcf/d. -

Figure 2: Electricity Generation by Fuel Type (2021)

Source and Description:

Source:

CER – Canada's Energy Future 2023 Data Appendix for Electricity GenerationDescription:

This pie chart shows electricity generation by source in Canada. A total of 625.7 TWh of electricity was generated in 2021. -

Figure 3: Crude Oil Infrastructure Map

Source and Description:

Source:

CERDescription:

This map shows major CER-regulated crude oil pipelines and rail lines in Canada.Download:

PDF version [2,447 KB] -

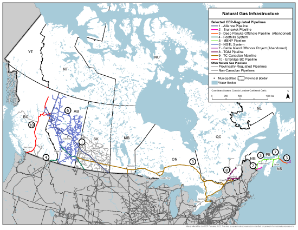

Figure 4: Natural Gas Infrastructure Map

Source and Description:

Source:

CERDescription:

This map shows major CER-regulated natural gas pipelines in Canada.Download:

PDF version [1,940 KB] -

Figure 5: End-Use Demand by Sector (2020)

Source and Description:

Source:

CER – Canada's Energy Future 2023 Data Appendix for End-Use DemandDescription:

This pie chart shows end-use energy demand in Canada by sector. Total end-use energy demand was 11,059 PJ in 2020. The largest sector was industrial at 53% of total demand, followed by transportation (at 20%), residential (at 14%), and lastly, commercial (at 13%). -

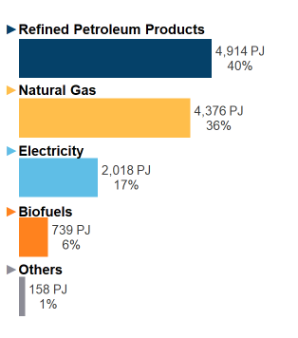

Figure 6: End-Use Demand by Fuel (2020)

Source and Description:

Source:

CER – Canada's Energy Future 2023 Data Appendix for End-Use DemandDescription:

This figure shows end-use demand by fuel type in Canada in 2020. Natural gas accounted for 4,164 PJ (38%) of demand, followed by refined petroleum products at 4,077 PJ (37%), electricity at 1,990 PJ (18%), biofuels at 700 PJ (6%), and other at 128 PJ (1%).

Note: "Other" includes coal, coke, and coke oven gas. -

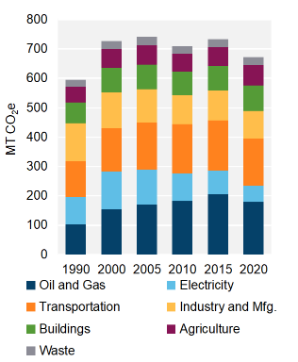

Figure 7: GHG Emissions by Sector

Source and Description:

Source:

Environment and Climate Change Canada – National Inventory Report 1990-2022Description:

This stacked column graph shows GHG emissions in Canada by sector from 1990 to 2022 in MT of CO2e. Total GHG emissions have increased in Canada from 608 MT of CO2e in 1990 to 708 MT of CO2e in 2022. -

Figure 8: Emissions Intensity of Electricity Generation

Source and Description:

Source:

Environment and Climate Change Canada – National Inventory Report 1990-2022Description:

This column graph shows the emissions intensity of electricity generation in Canada from 1990 to 2022. In 1990, electricity generated in Canada emitted 220 g of CO2e per kWh. By 2022, emissions intensity declined to 100 g of CO2e per kWh.

Energy Production

Crude Oil

- Canada produced 5.1 million barrels per day (MMb/d) of crude oil in 2023, an increase of 1.9% from 2022 (Figure 1). Canada was ranked as the fourth largest oil producer in the world in 2023.Footnote 1 Since 2013, Canada’s crude oil production has increased by 41%.

- Canadian oil production mainly comes from western Canada, which accounted for about 96% of total production in 2023. The remainder was produced mostly in Newfoundland and Labrador.

- Alberta was Canada's largest producer of oil in 2023 (at 84% of the total), followed by Saskatchewan and Newfoundland. These are also the only three provinces that produce heavy oil.

- Canada’s crude oil primarily serves export markets. In 2023, Canada exported an average of 4.0 MMb/d (nearly 80% of its total production).Footnote 2 Nearly all these volumes are exported to the United States (U.S.). Since 2010, exports have increased by 104%.

- Canada holds some of the largest oil reserves in the world—11% of the world’s reserves. Only Venezuela and Saudi Arabia had more as of 2020.Footnote 3

Refined Petroleum Products (RPPs)

- RPPs are a range of products that are refined from crude oil, like gasoline, diesel, heating oil, and jet fuel. RPPs are the second largest type of energy consumed by end users in Canada.

- Canada has 17 refineries with a total capacity of approximately 1.93 MMb/d as of 2024. Alberta has the largest share of refining capacity (30%), followed by Ontario and Quebec (21% each), New Brunswick (17%), Saskatchewan (8%), British Columbia (B.C.) (4%), and Newfoundland (1%).

- In 2023, Canadian refineries operated at 89% of capacity, on average, and consumed 1.6 MMb/d of crude oil.Footnote 4

- The Irving Oil Refinery in Saint John, New Brunswick, is Canada’s largest refinery, with a capacity of 320 thousand barrels per day (Mb/d).Footnote 5

- The refinery in Come by Chance, Newfoundland, closed in April 2020 and was converted to the Braya Renewable Fuels refinery under new ownership. In February 2024, the facility commenced commercial operations with an initial production capacity of 18 Mb/d of renewable diesel.Footnote 6

- The Sturgeon Refinery in Redwater, Alberta, is Canada’s first refinery to be constructed since 1984. It commenced commercial operation in June 2020.Footnote 7 It features carbon capture and storage and captures up to 1.3 million tonnes of carbon per year, which is transported on the Alberta Carbon Trunk Line (ACTL).Footnote 8

Natural Gas/Natural Gas Liquids (NGLs)

- In 2023, Canada was the fifth largest natural gas producer in the world.Footnote 9 Production averaged 17.9 billion cubic feet per day (Bcf/d) in 2023, a 3.6% increase from 17.3 Bcf/d in 2022 (Figure 1).

- Most of the natural gas produced in Canada comes from Alberta and B.C. These provinces accounted for 98% of Canada’s total production in 2023. Smaller amounts of natural gas were produced in Saskatchewan, Ontario, the Northwest Territories (NWT), and New Brunswick. Nova Scotia stopped producing natural gas and NGLs in 2018 when the Sable Offshore Energy Project shut down.Footnote 10

- In 2022, Canada’s production of NGLs was 928.2 Mb/d, not including condensate and pentanes plus, which are included with crude oil production.

Electricity

- In 2021, Canada produced 625.7 terawatt-hours (TWh) of electricity. More than half of the electricity in Canada (60%) is generated from hydroelectricity. The remainder is produced from sources including nuclear, natural gas, wind, coal, biomass, solar, and petroleum (Figure 2). In 2023, Canada was the third largest generator of hydroelectricity in the world.Footnote 11

- Each province has jurisdiction over electricity generation, intra-provincial transmission, and distribution while the federal government has authority over some aspects of the nuclear generation sector, electricity exports, and designated international and inter-provincial transmission lines.

- Most provinces and territories have government-owned utilities that generate and distribute electricity. Some of these provinces are also supported by smaller privately-owned utilities or independent power producers that provide additional generation and/or distribution services. Others, such as Alberta and Ontario, have competitive markets for electricity generation and distribution, with broad participation by privately-owned utilities.

- Different jurisdictions use different sources for power generation. B.C., Manitoba, Quebec, and Newfoundland and Labrador typically generate over 85% of their electricity from hydro; Yukon generates over 70% of its electricity from hydro. Prince Edward Island generates 99% of its electricity from wind. Ontario, New Brunswick, and NWT rely on a mix that can include nuclear, hydro, wind, biomass, coal, natural gas, and petroleum—although not all provinces or territories use all of them. Alberta, Saskatchewan, Nova Scotia, and Nunavut generate most of their electricity from fossil fuels like natural gas, coal, or petroleum.

- Generation from wind farms and solar photovoltaic panels grew from 1.5% of total electricity generation in 2010 to 7% in 2021.

- In 2021, Canada’s wind power capacity was roughly 13.9 gigawatts (GW). Most of the wind facilities in Canada are in Ontario, Quebec, and Alberta.

- In 2021, Canada had about 3.4 GW of solar power capacity, mostly in Ontario.

Uranium

- Canada is the world’s second largest producer of uranium, accounting for roughly 15% of global production in 2022.Footnote 12 Canada produced 11,373 tonnes of uranium in 2023.Footnote 13 Approximately 85% of Canadian production is exported, with the remaining 15% used to fuel reactors in Ontario and New Brunswick.Footnote 14

- Saskatchewan is currently the only province that produces uranium in Canada. Uranium was previously mined in Ontario and NWT as well. Production comes mainly from the McArthur River and Cigar Lake mines in northern Saskatchewan.

- Cameco’s McArthur River/Key LakeFootnote 15 mine in northern Saskatchewan is the largest high-grade uranium mine in the world.Footnote 16 Production at McArthur River/Key Lake was suspended in January 2018 due to weak uranium prices but was restarted in November 2022.Footnote 17

- The world’s largest uranium refinery is operated by Cameco and located in Blind River, Ontario.Footnote 18 Refined uranium is then shipped to conversion facilities for further manufacturing into fuel.

Hydrogen

- In December 2020, the Government of Canada released its Hydrogen Strategy for Canada.Footnote 19 The strategy focused on enabling Canada to become a top global producer of low-carbon hydrogen. A Progress Report was released in April 2024.Footnote 20

- Early success of small hydrogen projects has led to larger, more integrated projects in Canada. Notable early projects like the Raglan MineFootnote 21 and Bella Coola HARP projectFootnote 22 have reduced reliance on diesel in remote locations.

- In Alberta, carbon is captured during hydrogen production at the North West Sturgeon Refinery.Footnote 23 Fort Saskatchewan is also home to a blending pilot project by ATCO.Footnote 24 The project began in October 2022 and allows ATCO to deliver a blend of natural gas containing up to 5% hydrogen into part of Fort Saskatchewan's natural gas distribution network.

- Also in Alberta, several hydrogen projects are in the planning phase. Air Products announced that it plans to build a $1.3 billion facility in Edmonton that will produce hydrogen derived from natural gas, with operations expected to start in 2024.Footnote 25 The hydrogen will be used as emission-free transportation fuel across western Canada. Additionally, Suncor Energy has partnered with ATCO to produce more than 300,000 tonnes per year of low-carbon hydrogen.Footnote 26 An investment decision for the Suncor-ATCO project is expected by 2024, and it could be operational by 2028.

- In Ontario, the Enbridge-Cummins energy storage facility can store excess renewable energy as hydrogen.Footnote 27 In early 2022, Enbridge Gas and Cummins completed a project to blend this hydrogen into the Enbridge Gas natural gas network in Ontario.Footnote 28

- The world’s largest proton-exchange membrane electrolyzer was completed in 2021 in Bécancour, Quebec.Footnote 29 The 20-megawatt (MW) electrolyzer uses Quebec’s hydroelectric resources to produce green hydrogen.

Energy Transportation and Trade

Crude Oil and Liquids

- Canada’s large pipeline system serves both domestic refineries and export markets (Figure 3). The CER regulates all interprovincial and international crude oil pipelines.

- Total crude oil exports in 2023 were 4.0 MMb/d, 3% higher than 2022. Nearly all these volumes are exported to the U.S. The total value of Canada’s crude oil exports in 2023 was over $130 billion, an 11% decrease from 2022’s record high of $150 billion due to lower crude oil prices.Footnote 30

- In 2023, Canada exported about 3.2 MMb/d of heavy oil and 0.8 MMb/d of light oil. In 2023, heavy crude oil accounted for 79% of all crude oil exported from Canada. Since 2019, heavy crude oil exports increased by 10%.

- In 2023, the U.S. Midwest, or PADD II (Petroleum Administration for Defense District region 2),Footnote 31 received 61% of Canada’s total crude oil exports, making it Canada’s largest market. The U.S. Gulf Coast (PADD III) received 18%. PADD III is Canada’s fastest-growing market, with exports increasing by almost 500% since 2013. This is partly due to declining imports into the U.S. from Venezuela and Mexico – two other producers of heavy oil.

- In 2023, 92% of crude oil exports were transported by pipeline. About 5% were exported by marine vessel and 3% were exported by rail.

- The majority of Canada’s crude oil exports are transported by four pipelines: Enbridge’s Canadian Mainline,Footnote 32 South Bow Corporations’ (formerly TC Energy) Keystone Pipeline,Footnote 33 Trans Mountain Pipeline,Footnote 34 and Enbridge’s Express Pipeline.Footnote 35

- Canada has 32 crude oil rail loading facilities located in western Canada, with a total estimated loading capacity of 1.3 MMb/d.Footnote 36 In 2023, the volume of crude oil exported by rail averaged 98 Mb/d, a decrease from 143 Mb/d in 2022. Rail exports reached a record high of 412 Mb/d in February 2020.

- Canadian refineries are primarily supplied with crude oil by pipeline, but refineries on the East Coast have no pipeline access and rely on marine and rail for supply.

- Imports of crude oil increased by almost 5% in 2023, from 467 thousand barrels per day (Mb/d) in 2022 to 490 Mb/d in 2023. In general, provinces with refineries located further from western Canadian production sources—namely Ontario, Quebec, and New Brunswick—consistently import the most crude oil.

- Alberta’s refineries supply RPPs to the Prairies through Enbridge’s Canadian Mainline and to B.C. through the Trans Mountain Pipeline. Alberta also supplies RPPs to neighbouring provinces by rail and truck.

- Quebec delivers petroleum products primarily to Ontario via the Trans-Northern Pipeline,Footnote 37 Canada’s largest interprovincial RPP pipeline, and by rail, ship, and truck.

- Exports of Canadian RPPs are primarily from the Saint John Refinery in New Brunswick. Smaller volumes are also exported to the U.S. from Quebec, Alberta, Ontario, and B.C.

- Quebec, Ontario, B.C., and the Atlantic provinces are the primary importing regions for RPPs.

- Canada imports condensate from the U.S. on Enbridge’s Southern LightsFootnote 38 and Pembina’s Cochin.Footnote 39 Condensate imported into Alberta is used primarily as a diluent, which is mixed with heavy oil and bitumen so it can be transported on pipelines.

Natural Gas

- In 2023, Canada exported an average of 8.1 Bcf/d of natural gas and imported 2.5 Bcf/d. The net export value of natural gas in 2023 was $10.1 billion.Footnote 40

- Canada has a vast network of natural gas pipelines (Figure 4). Natural gas generally flows from producing areas in the Western Canada Sedimentary Basin (WCSB) to consuming markets in western Canada, central Canada, and the U.S. TC Energy’s Canadian MainlineFootnote 41 is the primary long-haul natural gas pipeline in Canada. It extends from the NGTLFootnote 42 system at the Alberta/Saskatchewan border across Saskatchewan, Manitoba, Ontario, and through a portion of Quebec. Several other interprovincial and international pipelines regulated by the CER also transport Canadian gas to domestic and U.S. markets. These include Alliance,Footnote 43 Westcoast (also known as BC Pipeline),Footnote 44 Foothills,Footnote 45 and Trans-Quebec and Maritimes.Footnote 46

- Almost all of Canada’s exported natural gas is transported to the U.S. via pipelines, while a very small amount is exported by trucks or ships as compressed natural gas (CNG) or liquefied natural gas (LNG).

- Most natural gas imports are delivered through pipelines from the U.S. into Ontario. Between 2012 and 2017, three terminals on the TC Energy Canadian Mainline in southern Ontario were modified from export points to bi-directional points in response to growing shale gas production in northeastern U.S.

- Natural gas is also imported to serve New Brunswick and Nova Scotia. The Martimes and Northeast pipelineFootnote 47 carries gas imported from the U.S. and the Emera Brunswick pipelineFootnote 48 imports liquefied natural gas produced internationally.

Liquefied Natural Gas (LNG)

- LNG CanadaFootnote 49 in Kitimat, B.C., and Woodfibre LNGFootnote 50 in Squamish, B.C., are the only proposed LNG export facilities in Canada that have started construction. The first shipments from LNG Canada are expected by the middle of 2025.Footnote 51

- The Saint John LNG terminalFootnote 52 in New Brunswick, formerly known as Canaport, is Canada’s only LNG import terminal since 2009. The Saint John LNG import terminal can deliver up to 1.2 Bcf/d of natural gas to markets in the Maritimes and northeastern U.S., but actual volumes are much lower because LNG is not regularly imported into Canada by marine vessels.

- Some provinces and territories have small-scale LNG facilities for a variety of uses, including transportation fuel (marine and fleet vehicles) and power generation. LNG can also be stored to supply natural gas during times of peak demand (for example, the LNG storage facilities in Delta, B.C., Sudbury, Ontario, and Montreal, Quebec).

- Canada has exported small volumes of LNG from FortisBC’s Tilbury Island LNG facilityFootnote 53 to China by marine vessel, since late 2017.Footnote 54

Electricity

- Canada is typically a net exporter of electricity.Footnote 55 In 2023, net exports were 27.6 TWh, a 46% decrease from 51.3 TWh in 2022, mainly due to abnormally dry weather in 2023.Footnote 56 All electricity trade is with the U.S. and mostly occurs from the provinces of Quebec, Ontario, Manitoba, and B.C.

- There are 1,522 km of operating international transmission lines connecting Canada to the U.S.Footnote 57

- The value of Canada’s exported electricity in 2023 was just under $4.3 billion and the value of imports was $1.9 billion, resulting in a net export value of around $2.4 billion.Footnote 58

Energy Consumption and Greenhouse Gas (GHG) Emissions

Total Energy Consumption

- Total end-use energy demand in Canada was 11,059 petajoules (PJ) in 2020. The largest sector for energy demand was industrial at 53% of total demand, followed by transportation at 20%, residential at 14%, and commercial at 13% (Figure 5).

- In 2020, natural gas was the main energy consumed in Canada, accounting for 4,164 PJ, or 38%, of consumption. Refined petroleum products and electricity accounted for 4,077 PJ (37%) and 1,990 PJ (18%), respectively (Figure 6).

Refined Petroleum Products

- Total demand in Canada for RPPs in 2020 was 4,077 PJ. The primary products consumed were gasoline and diesel. Other products include heavy fuel oil, asphalt, and lubricants.

- Per capita consumption of motor gasoline in 2022 was 1,035 litres. Motor gasoline consumption was highest in Saskatchewan at 1,878 litres per capita, and lowest in Nunavut at 565 litres per capita.

- Per capita consumption of diesel in 2022 was 772 litres. Diesel consumption was highest in the Northwest Territories at 4,740 litres per capita, and lowest in New Brunswick at 480 litres per capita.

- Gasoline in western Canada and Ontario is primarily produced with western Canadian crude oil, while gasoline in Quebec and Atlantic Canada is produced using a mix of western Canadian, offshore Atlantic Canadian, and imported crude oils.

- Growing production, new pipeline capacity, and new rail offloading facilities in eastern Canada have allowed western Canadian and U.S. crude oil to increasingly displace overseas imports by eastern Canadian refineries.

Natural Gas

- Canada consumed an average of 11.9 Bcf/d of natural gas in 2023. Alberta used the most natural gas at 6.9 Bcf/d, followed by Ontario at 2.8 Bcf/d, and B.C. at 0.6 Bcf/d.

- Canada’s largest consuming sector for natural gas was the industrial sector, which consumed 9.0 Bcf/d in 2023. The residential and commercial sectors consumed 1.5 Bcf/d and 1.4 Bcf/d, respectively.

Electricity

- In 2020, annual electricity consumption per capita in Canada was 14.6 megawatt-hours (MWh). Quebec ranked the highest for annual electricity consumption at 22.9 MWh per capita, and Nunavut ranked the lowest at 6.1 MWh per capita.

- Canada’s largest consuming sector for electricity in 2020 was industrial at 230 TWh. The residential and commercial sectors consumed 177 TWh and 145 TWh, respectively. The transportation sector consumed 1 TWh.

GHG Emissions

- Canada’s GHG emissions in 2022 were 707.8 megatonnes of carbon dioxide equivalent (MT CO2e).Footnote 59 Canada’s emissions have increased 16.5% since 1990 and declined 7.1% since 2005.Footnote 60

- Canada’s per capita emissions were 18.2 tonnes CO2e in 2022.

- Canada’s share of global annual GHG emissions has been below 2.0% since 1990. Despite this low share, Canada ranks among the highest of the developed nations for GHG emissions per capita, along with Australia, Luxembourg, and the U.S.Footnote 61

- The largest sector for GHG emissions in Canada is oil and gas production, which emitted 216.7 MT CO2e in 2022. Transportation was the second largest emitter with 156.3 MT CO2e, followed by industries and manufacturing at 105.1 MT CO2e, and buildings at 88.8 MT CO2e (Figure 7).

- Of the 216.7 MT CO2e emitted by the oil and gas sector in 2022, 198.2 MT CO2e were attributable to production, processing, and transmission and 18.5 MT CO2e were attributable to petroleum refining and natural gas distribution.

- Canada’s GHG emissions from power generation declined 59% between 2005 and 2022. Most of this reduction came from Ontario’s phase-out of coal-fired generation. Between 2000 and 2022, Ontario’s GHG emissions from electricity declined from 43.0 MT CO2e to 3.8 MT.

- In recent years, further reductions have been a result of Alberta’s coal phase out and transition to natural gas-fired generation and renewables. Between 2015 and 2022, Alberta’s GHG emissions from electricity declined from 41.3 MT CO2e to 19.4 MT CO2e.

- Alberta and Saskatchewan are the provinces with the highest emissions from power generation. In 2022, Alberta generated 41% of Canada’s total GHG emissions from power generation and Saskatchewan accounted for 28%.

- The greenhouse gas intensity of Canada’s electricity grid, measured as the GHGs emitted in the generation of the country’s electric power, was 100 grams of CO2e per kilowatt-hour (g of CO2e/kWh) in 2022. This is a 55% reduction from the 2005 level of 220 grams of CO2e/kWh (Figure 8). The greenhouse gas intensity of the European Union's electricity grid, including all 27 member countries, averaged 258 grams of CO2e/kWh in 2022. The U.S. electricity grid GHG intensity was 390 grams of CO2e/kWh in 2022.

Energy Authorities

- CER: Crude Oil Export Summary

- CER: Annual Electricity Exports and Imports Summary

- CER: Annual Natural Gas Exports and Imports Summary

- CER: Crude Oil and Petroleum Products Statistics & Analysis

- CER: Canada’s Energy Future

- CER: Canada's Renewable Power

- CER: Market Snapshots

- Natural Resources Canada

- Environment and Climate Change Canada

- Environment and Climate Change Canada: Canada’s Greenhouse Gas Inventory

- Canadian Association of Petroleum Producers

- Canadian Fuels Association

- Canadian Gas Association

- Canadian Hydrogen Fuel Cell Association

- Canadian Renewable Energy Association

- Canadian Solar Industries Association

- Date modified: