ARCHIVED – National Energy Board Cost Recovery Regulations for the Electricity Industry – De-mystifying Cost Recovery Fees (It’s easy as A B C)

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

De-mystifying Cost Recovery Fees (It’s easy as A B C)

Hotel Queen Elizabeth, Montréal

2 June 2005

A. Principles

- The National Energy Board Act (Sec. 24.1) empowers the NEB to make regulations:

- imposing charges to recover costs attributable to its activities, and

- providing for the manner of calculating those charges

A. Principles (continued)

- Under the Regulations, companies are invoiced for:

- Recoverable Costs

- Approximately ¾ of NEB costs are salaries

- The remaining costs are classified as operating and maintenance

- Not all costs are recoverable

- Recoverable Costs

A. Principles (continued)

- Recoverable costs do not include costs for activities relating to, e.g.:

- frontier areas (e.g. COGOA lands)

- work on behalf of other departments/agencies

- overheads pertaining to non-recoverable costs

A. Principles (continued)

- Assurance

- The Auditor General performs an annual audit of NEB costs

- The pool of Recoverable Costs is certified

- For purposes of cost recovery, the fiscal period is the calendar year

B. Concepts

- Companies pay their share of recoverable costs in 3 ways:

- “Greenfield” levies (pipeline start-ups only - Sec 5.2)

- Fixed fees (small, intermediate companies and “other” commodities)

- Sharing remaining pool of costs (large companies)

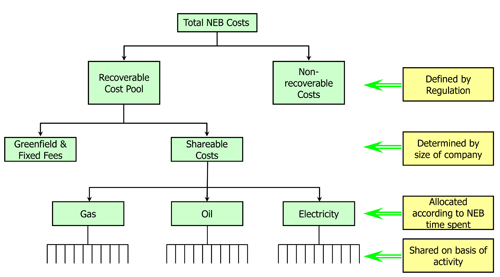

The Allocation “Cascade”

The Allocation “Cascade

Total NEB Costs = Recoverable Cost Pool + Non-recoverable Costs.

(Defined by Regulation)

Recoverable Cost Pool = Greenfield & Fixed Fees + Shareable Costs.

(Determined by size of company)

Shareable Costs = Gas + Oil + Electricity.

(Allocated according to NEB time spent)

Sub-categories.

(Shared on basis of activity).

B. Concepts (continued)

- Allocation Principles

- Allocation of costs to commodity categories is based on time spent on each commodity - gas, oil, electricity.

- Non-specific time (i.e. not attributed to a specific commodity) is allocated across all commodities in proportion to the time spent on those commodities.

- Within each commodity group, costs are shared according to activity levels (throughputs, exports).

B. Concepts (continued)

- Cap on fees (Sec 4.1)

- For large oil, gas and commodity pipelines, fees may be capped at 2% of the cost of service for that company. (Company must apply for relief.)

- Electricity export averaging

- Sharing of costs allocated to large electricity exporters is based on a 4 year rolling average of export activity.

C. Process

- Obtain relevant company operating data

- Throughputs, exports, cost of service (August 31)

- actuals for previous year(s)

- forecast for current year

- forecast for next year

- Throughputs, exports, cost of service (August 31)

C. Process (continued)

- Determine estimate of next year’s recoverable costs

- obtain NEB budgets for current and next fiscal years

- adjust fiscal years to calendar estimate budget for next calendar year

- calculate estimate of recoverable costs for next calendar year

C. Process (continued)

- Obtain audited results for previous calendar year

- Calculate difference between previous year’s estimated costs and audited actual costs

- Determine adjustment (if any) for each company

- Calculate estimated billing for each company for the coming year– adjusted for differences determined in Step 5

C. Process (continued)

- Issue information package with preliminary estimated billing information (September 30)

- Receive applications for relief under Sec 4.1 (October 31)

C. Process (continued)

- Issue (December 31) final estimated billing for coming year reflecting:

- final estimate of NEB recoverable cost for next year

- adjustments arising from differences between estimates and actuals from preceding year

- reallocations arising from approved applications for relief

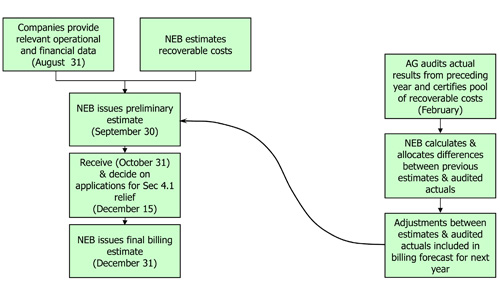

Cost Recovery Estimated Billing Process

Cost Recovery Estimated Billing Process

Slide Description

| AG audits actual results from preceding year and certifies pool of recoverable costs (February) |

|||

|

|||

| Companies provide relevant operational and financial data (August 31) |

NEB estimates recoverable costs | NEB calculates & allocates differences between previous estimates & audited actuals | |

|

|

||

| NEB issues preliminary estimate (September 30) |

|

Adjustments between estimates & audited actuals included in billing forecast for next year | |

|

|||

| Receive (October 31) & decide on applications for Sec 4.1 relief (December 15) |

|||

|

|||

| NEB issues final billing estimate (December 31) |

|||

C. Process (continued)

- During the next year, issue quarterly invoices to large companies and single invoice at mid-year to small and intermediate companies based on estimated fees.

The End

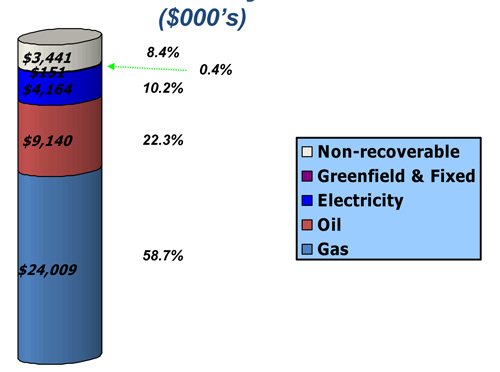

Cost Recovery - 2003 ($000’s)

Cost Recovery - 2003 ($000’s)

Slide Description

Non-recoverable - $3,441 - 8.4%

Greenfield & Fixed - $151 - 0.4%

Electricity - $4,164 - 10.2%

Oil - $9,140 - 22.3%

Gas - $24,009 - 58.7%

Total NEB costs for 2003 - $40,906,000

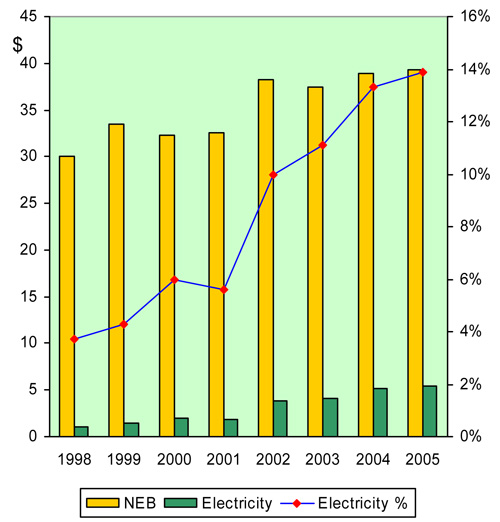

NEB & Electricity Costs - 1998 to 2005 ($ millions)

NEB & Electricity Costs - 1998 to 2005 ($ millions)

Slide Description

NEB & Electricity Costs – 1998 to 2005

($ millions)

| Year | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 |

|---|---|---|---|---|---|---|---|---|

| Recoverable Costs | 30.0 | 33.5 | 32.3 | 32.5 | 32.3 | 37.5 | 38.9 | 39.3 |

| Electricity portion of costs | 1.1 | 1.5 | 1.9 | 1.8 | 3.8 | 4.2 | 5.2 | 5.5 |

| Electricity costs as % of total NEB costs |

3.7 | 4.3 | 6.0 | 5.6 | 10.0 | 11.1 | 13.3 | 13.3 |

| 1998 to 2003 – audited costs 2004 & 2005 – estimated costs |

||||||||

- Date modified: