Market Snapshot: Two Decades of Growth in Renewable Natural Gas in Canada

Connect/Contact Us

Please send comments, questions, or suggestions for Market Snapshot topics to snapshots@cer-rec.gc.ca

Release date: 2023-04-19

Renewable natural gas or biomethane (RNG) production in Canada began in 2003 when the Trans Québec & Maritimes (TQM) Pipeline started receiving RNG captured from a landfill located near Sainte-Geneviève-de-Berthier, Quebec. Currently, the RNG on Trans Québec & Maritimes is mainly destined for export to the United States, but there are many more projects across the country that deliver RNG to natural gas distribution networks for local markets. The number of projects operating in Canada are expected to more than double between 2021 and 2025. Policy changes, like provincial mandates, and opt-in programsDefinition* are contributing to the increase in new projects. The 18 new RNG projects built after 2021 will increase Canada’s RNG capacity from 7.2 petajoules (PJ) in 2021 to 17.1 PJ in 2025.Footnote 1

Figure 1: Renewable Natural Gas Projects in Canada

Source and Description

Source: CER (see Table 1 below for more details and links to project sources)

Description: This interactive dashboard shows RNG (biomethane) projects in Canada. It includes projects that are upgrading biogas for pipeline injection. A time-series chart also shows the number of projects currently online, and the total stated capacity of projects, by year, from 2003 until 2027 (projected). The chart shows an increasing trend of RNG projects, starting with two projects in 2003 and reaching 39 projects in 2027. A map shows projects in British Columbia, Alberta, Ontario, and Quebec.

Provincial mandates contribute to an increase in RNG projects

In 2019, Quebec became the first province to mandate the inclusion of RNG in natural gas distribution. This regulation requires distributors to blend 1% RNG by 2020 and a minimum of 5% by 2025.Footnote 2 As part of the CleanBC strategy, British Columbia also committed to a minimum requirement of 15% renewable content in the natural gas stream by 2030.Footnote 3 New Brunswick is also exploring a minimum portion of RNG and/or hydrogen in the provincial natural gas supply.Footnote 4

Opt-in programs allow consumers to help fund RNG projects

Distribution companies have also created their own opt-in programs, giving customers the choice to pay a little more for their natural gas in order to fund RNG projects, like FortisBC in British Columbia and Enbridge Gas Inc in Ontario. Provincial mandates and opt-in programs have contributed to advancing new projects across the country.

Table 1 includes the 22 existing (as of 2022) and 17 planned, or under construction, projects that will process biogas into RNG to be injected into natural gas distribution systems. This data only includes specific project announcements with planned in-service dates. Additional projects in various stages of development not included here because these details have not been released publicly yet.

Table 1: 39 Current and Planned RNG Projects in Canada

| Project or Facility Name | Province | In-Service Date | Type | Stated Capacity (Petajoules/Year) | Sources |

|---|---|---|---|---|---|

| Les Entreprises Berthier inc. (EBI) Sainte-Geneviève-de-Berthier landfill | QC | 2003 | Landfill | 1.38 | EBI, CER [Document C18356-1] |

| Les Entreprises Berthier inc. (EBI) Rive Nord | QC | 2003 | Landfill | 1.21 | Canadian Gas Association |

| Salmon Arm Landfill | BC | 2011 | Landfill | 0.02 | Closing the Loop, Columbia Shuswap Regional District, Canadian Gas Association |

| Fraser Valley Biogas/Evergen Infrastructure Corp. (Abbotsford) | BC | 2011 | Agricultural and/or Food Waste | 0.08 | EverGen, Canadian Biomass News |

| Hamilton Woodward Wastewater Treatment Plant | ON | 2011 | Wastewater | 0.06 | Enbridge, TVO, Canadian Gas Association |

| Glenmore Landfill (Kelowna) | BC | 2014 | Landfill | 0.06 | FortisBC, FortisBC |

| Seabreeze Dairy Farm (Delta) | BC | 2014 | Agricultural and/or Food Waste | 0.04 | DMT |

| VisionEnviro Progressive's Lachenaie landfill | QC | 2015 | Landfill | 2.94 | Waste Today, Canadian Gas Association |

| Surrey Biofuel Facility | BC | 2018 | Agricultural and/or Food Waste | 0.12 | City of Surrey |

| Saint-Hyacinthe Biomethanation | QC | 2018 | Agricultural and/or Food Waste | 0.49 | NGV Global News, CER, Forbes |

| StormFisher - London Biogas Facility | ON | 2020 | Agricultural and/or Food Waste | 0.06 | Bioenergy Insight |

| Bioenergy Insight | AB | 2021 | Agricultural and/or Food Waste | 0.28 | Canadian Biomass News, Lethbridge Biogas, Skyline Group of Companies |

| Lulu Island Wastewater Treatment Plant (Richmond) | BC | 2021 | Wastewater | 0.06 | Environmental Science and Engineering Magazine, BOE Report |

| Coop Agri-Énergie Warwick | QC | 2021 | Agricultural and/or Food Waste | 0.09 | Coop Agri-Énergie Warwick, CER, la Voix de L’Est |

| ADM-Agri-Industries Company Candiac Project | QC | 2021 | Agricultural and/or Food Waste | 0.19 | Québec Ministère de l'Énergie et des Ressources naturelles |

| Dufferin Organics Processing Facility (Toronto) | ON | 2021 | Agricultural and/or Food Waste | 0.13 | City of Toronto, GHD, Biomass Magazine |

| Stanton Farms/Faromor CNG Corp. (Stratford) | ON | 2022 | Agricultural and/or Food Waste | 0.11 | Farmers Forum |

| StormFisher - London Biogas Facility - Expansion | ON | 2022 | Agricultural and/or Food Waste | 0.17 | Bioenergy Insight, Canadian Biomass |

| Centre de biométhanisation de l'agglomération de Québec | QC | 2022 | Agricultural and/or Food Waste | 0.38 | The Montreal Journal, CER |

| Centre de traitement de la biomasse de la Montérégie (Saint-Pie) | QC | 2022 | Agricultural and/or Food Waste | 0.15 | Centre de traitement de la biomasse de la Montérégie, Saint-Hyacinthe News, CER |

| Niagara Falls Renewable Natural Gas Plant | ON | 2022 | Landfill | 0.77 | Enbridge, GHD |

| Two Hills RNG Facility (Vegreville) | AB | 2022 | Agricultural and/or Food Waste | 0.23 | ATCO |

| Suez Montréal East Biomethanation Plant (Montreal) | QC | 2023 | Agricultural and/or Food Waste | 0.15 | Montreal Gazette, Montreal Gazette |

| City of Vancouver Landfill (Delta) | BC | 2023 | Landfill | 0.06 | Natural Gas Innovation Fund |

| Fraser Valley Biogas/Evergen Infrastructure Corp. (Abbotsford) -Expansion | BC | 2023 | Agricultural and/or Food Waste | 0.08 | EverGen, Canadian Biomass |

| Carbonaxion GNR Neuville | QC | 2023 | Landfill | 0.07 | Carbonaxion, PyroGenesis |

| Waga Energy – Enercycle, Saint-Étienne-des-Grès | QC | 2023 | Landfill | 0.47 | Biomass Magazine, Waga Energy |

| Waga Energy – Brome-Missisquoi Intermunicipal Waste Management Board (Cowansville) | QC | 2023 | Landfill | 0.11 | Waste 360, Energy Capital Magazine, Waga Energy |

| SEMECS Varennes Anaerobic Digestion Project | QC | 2023 | Agricultural and/or Food Waste | 0.16 | Clean 50, Montreal Gazette, Bioenergy Insight |

| Ridge Landfill Renewable Natural Gas (RNG) Project | ON | 2023 | Landfill | 1.59 | Enbridge |

| REN Energy International Corp. (Fruitvale) | BC | 2023 | Wood Waste | 1.20 | REN Energy, Woodworking Network |

| Disco Road Organics Processing Facility (Toronto) | ON | 2024 | Agricultural and/or Food Waste | 0.17 | City of Toronto, City of Toronto |

| High River RNG Facility | AB | 2024 | Agricultural and/or Food Waste | 0.53 | Daily Oil Bulletin, Tidewater Renewables Ltd. |

| Waga Energy – Capital Regional District (CRD), Hartland Landfill (Victoria BC) | BC | 2024 | Landfill | 0.37 | Capital Regional District, CTV News, Waga Energy |

| Foothills Boulevard Regional Landfill (Prince George) | BC | 2024 | Landfill | 0.09 | The Coalition for Renewable Natural Gas |

| WM Sainte-Sophie Landfill | QC | 2025 | Landfill | 3.04 | La Presse |

| Centre de traitement de la biomasse de la Montérégie (Saint-Pie) Expansion | QC | 2025 | Agricultural and/or Food Waste | 0.06 | Le Courrier de Saint-Hyacinthe |

| Green Lane Landfill (Toronto) | ON | 2026 | Landfill | 0.96 | City of Toronto |

| LaSalle Waste Treatment Centre (Montreal) | QC | 2027 | Agricultural and/or Food Waste | 0.15 | Nouvelles D’Ici |

Sources and Description

Sources: CER, based on information from the project sources listed in the table.

Description: This table lists RNG projects in Canada from those that went into service in 2003 to projects anticipated be on-line in 2027. This table is based on publicly available information.

What is renewable natural gas (RNG)?

Despite making up just 0.36% of the natural gas distributed in Canada in 2021Footnote 5, renewable natural gas (RNG) production has grown in recent decades. RNG is comprised of methane. Methane is also the primary component of traditional, or fossil fuel-derived natural gas. While natural gas from fossil fuels is produced primarily from drilling for gas trapped underneath rock formations, RNG is produced from waste products. RNG production is associated with landfill biogas capture, agriculture and/or food waste processing, wastewater processing, and wood waste processing. RNG projects contribute to a circular economyDefinition* by creating energy from waste products. RNG is also considered a low carbon-intensity fuel and contributes to reducing methane emissions.

What are RNG’s uses?

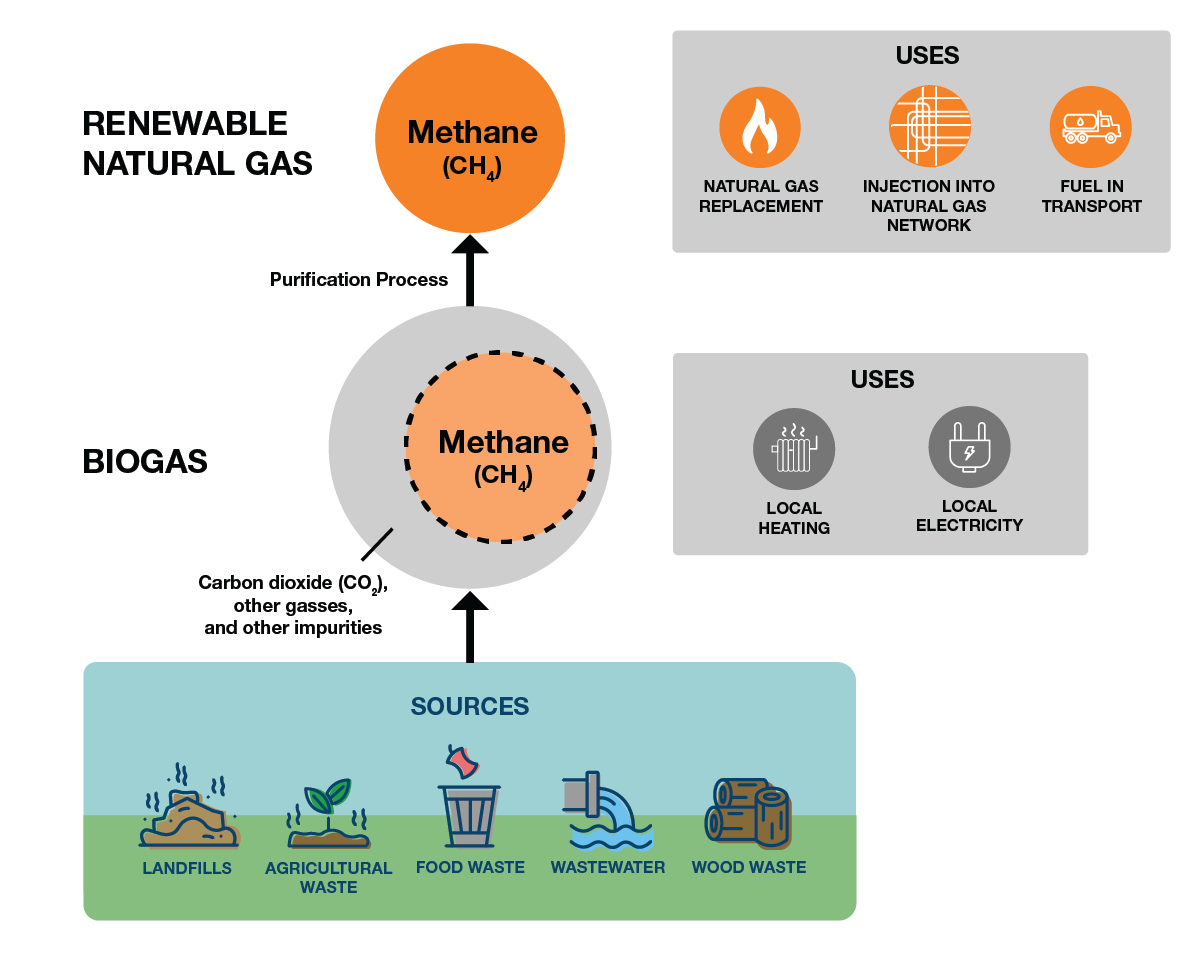

The raw gas produced from gasses trapped in landfills or from the breakdown of organics in sealed tanksDefinition* is called biogas and consists of methane, carbon dioxide, water, and other impurities. Biogas can be utilized locally for heating and electricity. However, biogas must be processed to remove impurities. Once processed, RNG is indistinguishable from natural gas and can be injected into natural gas distribution networks or used as fuel in heating, electricity, or transportation.

Figure 2: Biogas and renewable natural gas (RNG)

Source and Description

Source: CER

Description: This diagram shows biogas and renewable natural gas sources, components, and uses. Biogas sources are landfills, agricultural waste, food waste, wastewater, and wood waste. Biogas is made up of methane, carbon dioxide, and other gasses and is purified to become renewable natural gas. The uses of biogas are local heating and electricity. Renewable natural gas consists of methane and can replace fossil fuel-derived natural gas. It can be injected into natural gas networks or used as fuel in transport.

RNG is a low carbon-intensity fuel

RNG is a low carbon-intensity fuelDefinition* primarily because it comes from renewable organic sources like agricultural, wood and food waste.Footnote 6 The production of all energy sources involves associated life cycle emissionsDefinition*. Although life cycle emissions can vary for each project, RNG will reduce total emissions compared to fossil fuel-derived natural gas because RNG projects usually involve capturing methane generated from organic sources that otherwise would have been released into the atmosphereFootnote 7.

- Date modified: