ARCHIVED - Global and Canadian Context for Energy Demand Analysis - Energy Briefing Note

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

ISSN 1917-506X

Global and Canadian Context for Energy Demand Analysis - Energy Briefing Note [PDF 676 KB]

Energy Briefing Note

Global and Canadian Context

for Energy Demand Analysis

September 2008

Copyright/Permission to Reproduce

Table of Contents

- Foreword

- Introduction

- The Global Context: Unknowns Undermining Analysis

- Getting Perspective: Global Supply and Demand

- Canadian Context for Supply and Demand Analysis

- Technological Improvements

- Attitudes Towards Energy

- Understanding Energy Demand: Exploring the Resource Potential

- Observations

- Appendix 1 - Summary of Energy Use in Canada 1990-2004

- Appendix 2 - Provincial and Territorial Energy Conservation and Efficiency Programs

- Appendix 3 - Canada's Energy Flow: Primary Extraction to End-use

Foreword

The National Energy Board (NEB or the Board) is an independent federal agency that regulates several aspects of Canada's energy industry. Its purpose is to promote safety and security, environmental protection and efficient energy infrastructure and markets in the Canadian public interest[*] within the mandate set by Parliament in the regulation of pipelines, energy development and trade. The Board's main responsibilities include regulating the construction and operation of interprovincial and international oil and gas pipelines as well as international and designated interprovincial power lines. The Board regulates pipeline tolls and tariffs for pipelines under its jurisdiction. In terms of specific energy commodities, the Board regulates the exports and imports of natural gas as well as exports of oil, natural gas liquids (NGLs) and electricity. Additionally, the Board regulates oil and gas exploration, development and production in Frontier lands and offshore areas not covered by provincial or federal management agreements. The Board's advisory function requires keeping under review matters over which Parliament has jurisdiction relating to all aspects of energy supply, transmission and disposal of energy in and outside Canada.

The NEB monitors energy markets to objectively analyze energy commodities and inform Canadians about trends, events, and issues. The Board releases numerous research reports. This report is a briefing note - a brief report covering one aspect of energy commodities. Specifically, this energy demand report considers recent global and Canadian context issues that influence more detailed regional and sector specific analysis.

If a party wishes to rely on material from this report in any regulatory proceeding before the NEB, it may submit the material, just as it may submit any public document. Under these circumstances, the submitting party in effect adopts the material and that party could be required to answer questions pertaining to the material.

Introduction

This briefing note introduces an upcoming series of notes on Canada's energy demand. The series will discuss current trends, technology, policy, regulations, and social issues, and will explore opportunities and potential for shifts in energy demand. Many Canadians are questioning the economic and environmental sustainability of the current trend of increasing energy consumption. In addition, a growing global preoccupation about energy and related environmental issues has prompted everyone from energy experts to the general public to question fundamental assumptions about energy supply and demand. Although not immediately obvious, energy demand is dynamic. The ultimate extent of this dynamic depends on context, and this includes everything from market forces to evolving personal attitudes towards energy use. This briefing note considers the major issues of global and national context in order to support future detailed study into specific demand topics.

There is a general consensus that the energy market has changed considerably since the release of the NEB's report titled Canada's Energy Future in November 2007[1]. Our analysis at that time was based on the established trends and extensive consultations with energy experts in the early part of 2007. For example, our Reference Case was based upon existing energy policies and a consensus view of a long-term international oil price of US$50/barrel. However, beginning in 2007, there was a significant increase in energy prices such that oil prices averaged US$72/barrel. Canadian governments at all levels responded to public concerns and introduced policies to address climate change. There has been a notable shift in consumer preference for energy efficiency in buildings, appliances, and vehicles. These factors may indicate a change that could have long-term implications for Canada's domestic energy demand outlook.

[1] Canada's Energy Future - Reference Case and Scenarios to 2030. National Energy Board, November 2007.

The recent volatility of energy pricing and world energy supply fears can distract from focussed discussion on regional energy issues. It also alters fundamental market assumptions behind the NEB's own supply and demand analysis. Petroleum is the world's most-traded energy commodity, and Canada is both a buyer and seller on world markets. Canada has a market-orientated energy policy. According to Natural Resources Canada, markets are the most efficient means of determining supply, demand, prices and trade while ensuring an efficient, competitive and innovative energy system that is responsive to Canada's energy needs[2]. As such, Canadian consumers are exposed to fluctuations in pricing.

[2] Overview of Canada's Energy Policy. Natural Resources Canada, 2008.

Developing energy forecasts requires making many assumptions that will affect accuracy. Emerging technology, the rise and fall of world commodity prices, geopolitical conflict, and consumer behaviour and attitude changes all have a profound effect on energy demand trends. Energy projections are limited in their ability to anticipate major shifts in consumption at either a national or international level. The NEB regularly seeks input from national and international energy experts to support its assumptions. Although this briefing note series is essentially about energy demand in Canada, the overwhelming influence of global energy issues warrants some initial attention.

The Global Context: Unknowns Undermining Analysis

World vehicle stock is predicted to double, growing from approximately 1 billion today, to more than 2 billion by 2030. (IEA, World Energy Outlook 2007).

There is a growing perception that future energy demand will be dictated by the harsh realities of limited resources and high prices. Given that the International Energy Agency (IEA) reference scenario suggests world energy demand could grow 55 percent by 2030, and potentially double by 2050, supply stresses are inevitable[3]. The projected growth is not uniform and there are wide regional variances. For example, last year China's primary energy demand increased 7.7 percent. At the same time, primary energy consumption in the European Union actually decreased 2.2 percent[4]. Changing fuel types or sources also complicate the analysis of global trend statistics. As an example, the IEA outlook predicts total global coal use to increase 73 percent between 2005 and 2030. At the same time, announcements such as the phase-out of Ontario's coal generation plants by 2014 and the large number of proposed new coal plants in the U.S. presently on-hold, due to uncertainty over climate change regulations, reveal the level of complexity and contradictory information behind such predictions.

[3] World Energy Outlook. International Energy Agency (IEA), 2007.

[4] BP Statistical Review of World Energy. BP Energy, June 2008.

At a high level, the debate on future energy demand focuses largely on three main areas: energy supply/security, energy demand growth, and climate change. Each issue has multiple levels of complexity; however, an introduction to the issues and further considerations for analysis follows:

Table 1: Major Issues in Global Demand Context

| Issue | Perspective |

|---|---|

Energy security and energy supply Concern over adequacy of resources, "peak oil", energy consumption rates in relation to energy resource or reserve capacity, and economic stability. |

|

Energy demand growth Questions about the role of individual Canadians and regional energy demand management policies in a world in which growing population and rapidly expanding economies of some nations outpace growth in world energy supply. |

|

Climate change Concern over ever-increasing global economic growth, energy demand, and associated environmental impacts. |

|

Getting Perspective: Global Supply and Demand

To help with perspective on the broad issues, the IEA in its World Energy Outlook developed two scenarios related to global energy supply and demand: a Reference Case and an Alternative Scenario. The latter case features adoption of numerous policies worldwide to control greenhouse gasses. This includes higher efficiency standards for equipment and wider deployment of renewable energy.

Table 2: Key Supply and Demand Indicators

| World Energy Demand | IEA Reference Case |

IEA Alternative Scenario |

||

|---|---|---|---|---|

Annual population growth |

1.0% |

1.0% |

||

Annual economic growth (GDP) |

3.5% per year |

3.6% per year |

||

Required Investment (2006-2030) |

2.7 trillion |

2.3 trillion * |

||

Demand growth |

1.8% |

55% |

1.3% |

40% |

Oil demand growth |

1.3% |

116 mb/d |

0.6% |

102 mb/d |

Source: IEA (2007). Units: million barrels per day (mb/d)

$386 billion less, including energy efficiency investment. All amounts in $US (2006).

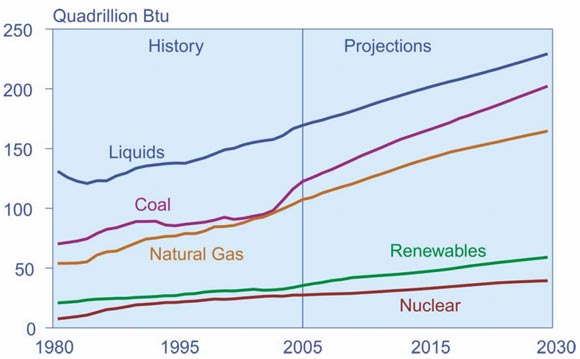

The dominance of fossil fuels in the fuel mix to 2030 is a consistent theme in global demand analysis. In the IEA scenarios, the range varies from 83 percent (Reference Case) to 76 percent (Alternative Scenario). The Energy Information Agency (EIA) in the U.S. has recently released its projection of demand growth and fuel mix (Figure 1). It also indicates a continuing reliance of fossil fuel use through to 2030[5].

[5] International Energy Outlook 2008 (Highlights). Energy Information Agency (EIA), 2008.

Developing countries are predicted to account for 74 percent of incremental world energy demand to 2030. Almost half of this increase is forecast to come from China and India alone. Both these countries have had spectacular economic growth in recent years (over 10 percent). This exceptional economic growth has contributed to some extreme energy demand predictions.

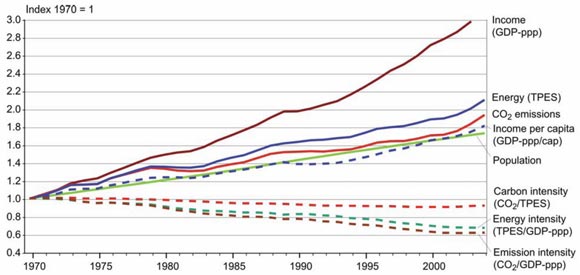

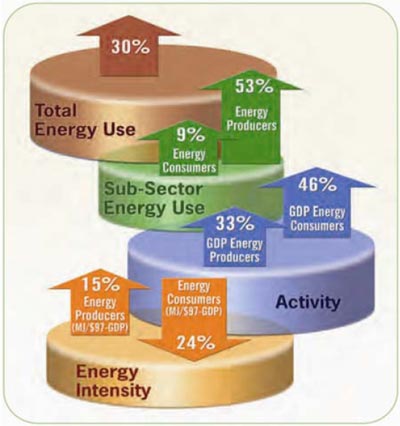

Economic growth is the dominant driver for increased energy consumption as historically, world energy demand has essentially tracked both increasing income and GDP (Figure 2). Due to efficiency improvements and fuel switching, energy intensity and emission intensity have improved.

Figure 1: Global Energy Demand Forecast - Fuel Mix

Source: EIA (IEA data), (2007)

Figure 2: Energy Intensity Relationship 1970-2005

Source: IEA, (2006)

Canadian Context for Supply and Demand Analysis

Canadians, in the midst of energy riches, face a perplexing paradox of energy supply and demand. As an example, Canada is in the enviable position of having the highest ratio of oil reserves-to-production ratios in world: 200 years versus a world average of 42 years[6]. Despite relatively abundant resources, the development of Canada's resources is subject to the uncertainties of world commodity markets. Additionally, resource transportation is limited by infrastructure that does not always favour nationwide, or east-west, flow.

[6] World Energy Outlook, International Energy Agency (IEA), 2006.

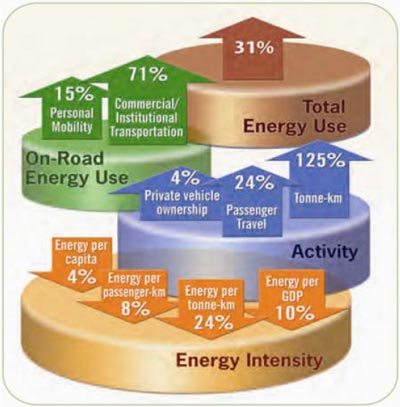

The historical trend (1990-2004) of energy demand in Canada could be characterized as one of robust growth with all sectors showing increasing demand. As illustrated in Appendix 1, total energy demand growth in this period was 23 percent. Energy demand growth by sector is as follows: 10 percent residential, 35 percent commercial, 30 percent for industry, and 31 percent for transportation. Although efficiency in all sectors has improved, the impact of a growing economy and population, as well as relatively inexpensive energy is clearly evident in the trend. According to NEB modeling, energy demand (Continuing Trends scenario) is expected to increase by 18 percent by 2015 and 35 percent by 2030[7].

[7] Canada's Energy Future - Reference Case and Scenarios to 2030. the National Energy Board, November, 2007.

A summary of some key indicators for energy in Canada based on the NEB's supply and demand modeling is shown below.

Table 3: Canada's Energy Future - Reference Case and Scenarios to 2030

| Reference Case/Continuing Trends 2004-2030 | Triple E 2004-2030* | |

|---|---|---|

Population growth |

0.7% year |

0.8% year |

Economic growth (GDP) |

2.5% year |

2.2% year |

Demand growth |

1.4% year |

0.3% |

Oil Production rate (annual growth) |

2.3% |

0.7% |

Oil Production rate (2030) |

4.7 mb/d |

3.1 mb/d |

* Apart from the overriding macro-economic differences between scenarios, the difference in demand growth between the two scenarios can be divided roughly into thirds based on: a) extensive energy efficiency measures, b) impact (price response) due to application of carbon pricing, and c) impact of renewable energy (non-primary) and structural changes in economy.

The NEB Reference Case demand analysis included over one hundred federal and provincial energy programs that were already in place in 2004. The last few years have seen a major resurgence in government-initiated energy demand management programs addressing supply, price, and environmental concerns. Energy and environmental policy proposals have been released in all provinces and territories in the last two years. These regulations and proposals are analyzed as part of the NEB's ongoing monitoring of energy demand. For a number of reasons, including time-lag for policy implementation and existing stock turn-over rates, the near-term impact of these specific programs is minor. While global issues such as energy commodity prices and economic growth will likely be the dominant driver for energy demand change in Canada, this does not detract from the significance of these policies, particularly at a provincial level.

Most provincial programs related to energy demand are embedded within broader climate change strategies. Every province has released new or updated energy and environment strategies that would reduce emissions. These strategies incorporate a mix of energy efficiency, energy conservation, renewable energy (including renewable fuel), and, in three cases, carbon pricing. Many of the announced initiatives are still under development at this time. There are, however, several policy announcements that will be considered as part of future demand analysis. One of the most notable is the B.C. Energy Plan which includes an aggressive demand side management (DSM) program, which will offset 50 percent of British Columbia's expected demand growth. The plan also includes requirements for zero-emissions electricity generation, renewable fuel standards, and a recently implemented carbon tax[8,9].

[8] BC Energy Plan - A Vision for a Clean Energy Leadership. B.C. Ministry of Energy, Mines, and Petroleum Resources, 2007.

[9] Balanced Budget 2008. B.C. Ministry of Finance, 2008. Available at: www.bcbudget.gov.bc.ca/2008/backgrounders/backgrounder_carbon_tax.htm

Ontario is also a leader in provincial energy policy related to demand management. A recent Ontario Power Authority proposal calls for demand management measures to reduce Ontario's electrical load by 6300 megawatt (MW) by 2025. Alberta has intensity based emission targets for industry starting in 2008. These programs will have an impact on provincial energy demand and national energy dynamics. A summary of the new provincial energy and environment strategies is attached as Appendix 2.

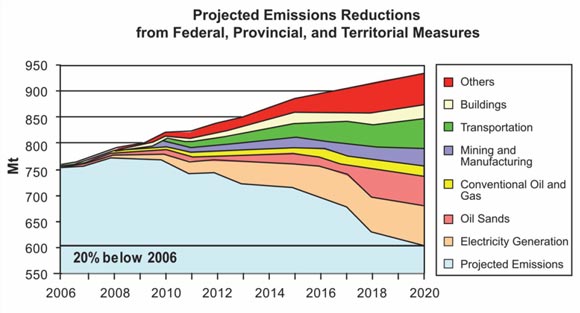

The most notable energy demand development at the federal level is based on Canada's Clean Air Regulatory Agenda included in the government report, Turning the Corner: An Action Plan to Reduce Greenhouse Gases and Air Pollution[10]. A target of 20 percent reduction in GHGs from 2006 levels by 2020 and 60 to 70 percent from current levels by 2050 is proposed. This would mean a 330 megatonne (Mt) reduction in greenhouse gases by 2020. Emissions reductions are not necessarily synonomous with energy demand reduction. Carbon capture and storage and increased renewable energy actually provide the majority of the emissions reduction, however, energy efficiency is still a major component. Environment Canada's analysis indicates that about one-third of the projected emissons reduction are directly allocated to secondary energy use efficiency improvements. Again, these emissions reduction-based programs indirectly provide the basis for updated energy demand analysis. With the number of federal and provincial announcements, the climate change agenda will have an unprecedented level of impact on demand.

[10] Turning the Corner Plan. Environment Canada, 2007.

The cornerstone of the federal climate change initiative is an intensity-based reduction, that is, GHG emissions per unit of output of 18 percent from 2006 levels by 2010, and 2 percent per year thereafter. This applies to each of the 16 major industrial sectors or large final emitters (LFEs). New efficiency based regulations are forthcoming in the building and transportation sectors as well. Measures include new building standards, appliance standards, lighting regulations, and vehicle fuel economy ratings. Achievement of the 20 percent reduction in emissions will rely heavily on changes in the transportation sector (through efficiency gains) and electric generation sector (through fuel switching and replacing existing generation with more efficient technology) (Figure 3).

Figure 3: Emission Reduction Estimates by Sector

Source: Environment Canada (2008)

Technological Improvements

Technological improvements are another fundamental driver of the NEB's energy demand model. Annual efficiency improvements are generally very slight and the evolution of most technology "breakthroughs" is measured in decades. That being said, in the last few years, investment in "green" technology has increased remarkably.

- In 2006, $71 billion was invested in renewable energy and energy efficiency. This is up by 43 percent in one year, and 158 percent over two years.[11]

- Between 2005 and 2006, investment in renewable energy sectors such as technology development, commercialization, and manufacturing firms jumped 140 percent.[12]

- In the same time period, venture capital and private equity investment jumped 163 percent.[13]

- World installed solar photovoltaic (PV) capacity grew 62 percent in 2007.[14]

[11] Global Trends in Sustainable Energy Investment 2007. United Nations Environment Programme, 2007.

[12] ibid

[13] ibid

[14] Marketbuzz 2008: Annual World Photovoltaic Industry Review. Solarbuzz, 2008.

Most technological investment has been directed towards the solar, wind, and biofuels sectors. It is interesting to note that energy efficiency attracted only about one percent of investment funding in 2006[15]. Overall, the level of investment is indicative of a hyperactive market and this supports many assumptions favouring clean technology breakthroughs. However, it is difficult to predict the winning technologies, their timing, and ultimate impact.

[15] Global Trends in Sustainable Energy Investment 2007. United Nations Environment Programme, 2007

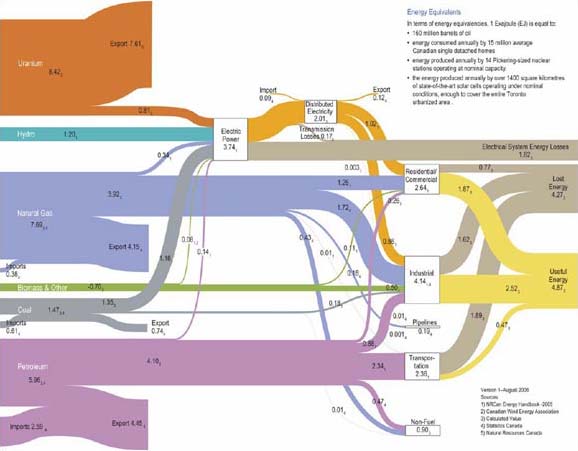

As an indication of the opportunity for improved efficiency gains in an energy-centered economy, approximately half of the energy content of primary fuels is lost by the time it reaches the end-use device (Appendix 3). Developing the efficiency opportunity will blur the traditional boundaries of end-use; for example, on-site power generation to allow waste heat recovery for heating or other uses. This evolving definition of end-use demand will make future energy demand analysis more complex.

Major transformations in energy demand have happened in the past and no doubt will happen again. Further briefing notes in this series will examine in detail, by sector, the many technology opportunities that have the potential to redefine energy use in the world.

Attitudes Towards Energy

Changes in public attitudes and behaviours towards the use of energy has perhaps the most significant influence on energy demand, but behaviours are the most difficult to quantify for the purposes of analysis. For example, will Canadians use public transit more often? Will Canadians reduce their electricity consumption? Public opinion polls and consumer spending habits would suggest a fundamental shift in attitude towards energy has evolved in the last few years. This is, in part, a straightforward price response that could be expected given high energy prices. Historically, however, the market has indicated energy demand is relatively inelastic. Future demand modeling will incorporate consumer demand response to a high energy cost regime. Further to this, it will be important to account for a rising social conscience which embraces conservation values and acts on them.

Demand analysis takes into account consumer behavior as much as quantifiably possible. Whether it is from an environmental or energy price perspective, this viewpoint influences how decisions are made, how systems are designed, and how devices and services are used. A few years ago, hybrid cars, green buildings and smart meters were considered marginal market influences; as they now move into the mainstream, energy demand analysis evolves.

Understanding Energy Demand: Exploring the Resource Potential

Understanding energy demand dynamics requires a thorough evaluation of historical demand trends, consideration of the hundreds of interacting elements of energy demand that can combine to produce major impacts, and making many assumptions on future trends. Appreciating the opportunity for energy demand to transition the economy, stabilize markets, enhance market efficiency, and offer a positive message for an energy future begins with a shared analysis of the opportunity. As the NEB faces larger and increasingly complex issues as part of its regulatory agenda, an expanded understanding of energy demand is fundamental to our purpose. With this in mind, our briefing note series will continue over the next year with topic-specific analysis. This work forms the foundation of data to be included in upcoming national energy supply and demand forecasts. The briefing notes will also serve as stand-alone information pieces that help fulfil the Board's mandate of informing Canadians about energy issues. Upcoming topics to be reviewed include:

- A review of new or proposed codes, standards, and regulations

- Attitudes and behaviour and impact on energy demand

- Update on transportation technology and policy

- A review of major trends and technology shifts in major industrial sectors

- New technology in demand-side management and smart-grid

- A review of new building technology and trends

- Concepts in urban design and its influence on energy demand

Observations

The level of energy demand related activity in both government policy and technology investment is indicative of renewed priorities. If the continuation of a business-as-usual trend in energy consumption is unacceptable, a thorough and highly integrated analysis of energy supply and demand is necessary in order to understand future options. The many uncertainties in the energy market at present only serve to reinforce the need for continual monitoring and analysis on energy demand issues. A deeper understanding of issues and options works to counteract the recent volatility in energy markets, and assists in building the long-term stability needed for appropriate future investment in Canada.

Appendix 1

Summary of Energy Use in Canada 1990-2004[16]

Overall Energy Use

Building Sector

Industrial Sector

Transportation Sector

[16] Moving Forward on Energy Efficiency in Canada: A Foundation for Action. Natural Resources Canada, 2007.

Appendix 2

Provincial and Territorial Energy Conservation and Efficiency Programs

Canada

The Government of Canada's plan to regulate greenhouse gas emissions and air pollutants. Environment Canada, 2008.

Climate Change: Leading Practices by Provincial and Territorial Governments in Canada. The Council of the Federation, 2007.

Alberta

2007 Progress Report. Climate Change Central, 2007.

Business Plan 2007-2010. Climate Change Central, 2007.

British Columbia

The BC Energy Plan: A Vision for Clean Energy Leadership. B.C. Ministry of Energy, Mines, Minerals and Resources, 2007.

Manitoba

Green and Growing: Building a Green and Prosperous Future for Manitoban Families. Manitoba Science, Technology, Energy and Mines, 2007.

New Brunswick

Efficiency NB. New Brunswick Department of Energy, 2007.

Newfoundland and Labrador

Focusing Our Energy. Newfoundland and Labrador Department of Natural Resources, 2007.

Northwest Territories

Energy and Efficiency Incentive Program (EEIP). Arctic Energy Alliance, 2008.

Nova Scotia

Renewed Energy and Climate Change Plan. Nova Scotia Department of Energy, 2008.

Nunavut

Nunavut Energy Management Program Policy. Nunavut Department of Community and Government Services, 2007.

Ontario Ministry of Energy Submission to the Canadian Energy Efficiency Alliance (CEAA): CEAA April 2006 Report Card. Ontario Ministry of Energy, 2006.

Prince Edward Island

Energy Framework and Renewable Energy Strategy. Prince Edward Island Depart of Energy and Minerals, 2004.

Québec

Using Energy to Build the Quebec of Tomorrow - Energy Strategy 2006-2015. Quebec Ministry of Natural Resources and Wildlife, 2006.

Ontario

Saskatchewan

Go Green Saskatchewan. Saskatchewan Ministry of Environment, 2007.

Yukon

An Energy Strategy for Yukon: Draft for Public Consultation. Yukon Department of Energy, Mines and Resources, 2008.

Energy Efficiency and Renewable Energy Programs that Work for Yukoners. Yukon Department of Energy, Mines and Resources, 2008.

Appendix 3

Canada's Energy Flow: Primary Extraction to End-use

Source: Powerful Connections: Priorities and Directions in Energy Science and Technology in Canada, Natural Resources Canada, 2006.

- Date modified: