ARCHIVED – Fact Sheet - Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 - Natural Gas Production Highlights

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 provides projections of Canadian energy supply and demand to the year 2040. Canada’s Energy Future 2016 includes a baseline projection, the Reference Case, based on the current macroeconomic outlook, energy price projections, and government policies and programs that were law or near-law at the time the report was prepared. EF 2016 includes additional projections that vary assumptions on energy prices, energy markets, and infrastructure. For detailed information, please see Chapter 6 of the full report.

Natural gas production is dominated by tight gas and dependent on prices and LNG exports.

- The number of natural gas wells drilled annually in Canada had been declining since 2005, largely due to lower natural gas prices and the focus on deeper, more productive wells, which require more days to drill.

- From 2018 onward, the number of natural gas wells drilled annually increases, driven by increased capital expenditures as natural gas prices rise. The number of natural gas wells will not reach the high levels witnessed during the 2005 to 2008 period. However, higher production rates from deep wells outpace the production declines from older wells leading to production increasing in Canada. The number of natural gas wells drilled each year rises from nearly 1 156 in 2014 to over 1 750 by 2040, including 610 Montney wells and nearly 60 Duvernay wells.

- This analysis assumes LNG exports start in 2019 at 14 106m³/d (0.5 Bcf/d) and increase by 14 106m³/d (0.5 Bcf/d) each year, reaching 71 106m³/d (2.5 Bcf/d) by 2023, after which they remain constant until the end of the projection period. This is an assumption rather than a projection. Exploration and development spending associated with LNG exports boost capital expenditures above what they would otherwise be. This leads to more natural gas wells and production in the WCSB. This LNG export assumption is the same for the Reference and High and Low Price cases.

Natural Gas Production

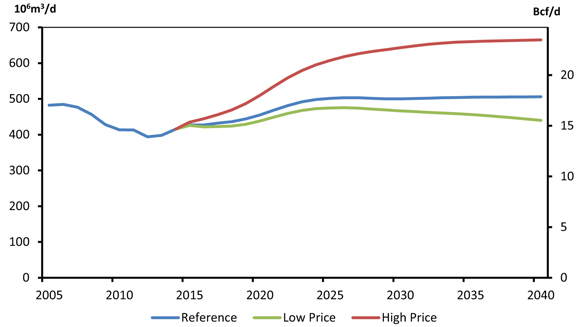

- In the Reference Case, Canadian marketable natural gas production increases slightly from 416 106m³/d (14.7 Bcf/d) in 2014 to 437 106m³/d (15.4 Bcf/d) in 2018. Rising prices and LNG exports support higher drilling levels and production ramps up continuously from 2019 to 2023. After 2023, production growth slows and production is relatively stable thereafter, reaching 506 106m³/d (17.9 Bcf/d) by 2040.

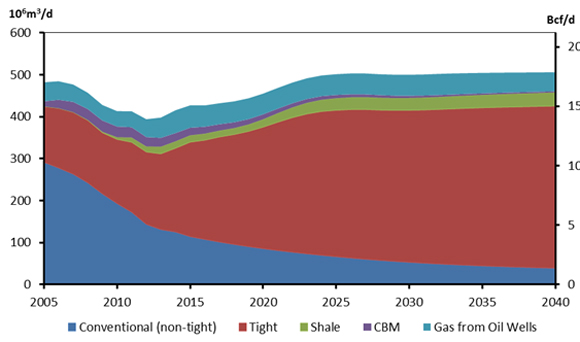

- Production increases continue in tight and shale natural gas, while non-tight conventional and coal bed methane (CBM) production continue to decline. Prior to 2009, conventional natural gas, not including tight natural gas, made up half or more of Canada’s annual production. With activity focusing on deep tight and shale resources in the projections, conventional natural gas accounts for only eight per cent of production by 2040, with tight natural gas making up 76 per cent and shale natural gas contributing six per cent of total production.

Natural Gas Production by Type, Reference Case

- Canadian marketable natural gas production in the High Price Case averages 665 106m³/d (23.5 Bcf/d) in 2040. Higher prices lead to higher production levels than in the Reference Case. Production from new wells offset older well production declines and additional drilling and production for LNG exports accelerates production growth from 2019 to 2023.

- Canadian marketable production in the Low Price Case increases from 2017 to 2026 in large part due to LNG exports. This is followed by production declines as prices are too low to encourage enough investment in new production and offset declining production from older wells. Marketable production increases to 475 106m³/d (16.8 Bcf/d) by 2026 and then declines to 440 106m³/d (15.5 Bcf/d) in 2040.

Total Canadian Marketable Natural Gas Production, Reference, High and Low Price Cases

- Date modified: