ARCHIVED – Fact Sheet - Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 - LNG Sensitivity Case Highlights

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 provides projections of Canadian energy supply and demand to the year 2040. Canada’s Energy Future 2016 includes a baseline projection, the Reference Case, based on the current macroeconomic outlook, energy price projections, and government policies and programs that were law or near-law at the time the report was prepared. EF 2016 includes additional projections that vary assumptions on energy prices, energy markets, and infrastructure. For detailed information on liquefied natural gas exports, see Chapter 11 of the full report.

The volume of liquefied natural gas exports is an important driver of Canadian natural gas production growth.

- Given the level of uncertainty related to Canadian LNG exports, Energy Futures 2016 explores the implications of higher and lower LNG exports from the B.C. Coast with two sensitivity cases: the High LNG and No LNG cases.

- The LNG cases vary the assumed LNG export volumes in the Reference Case to assess the effect on the Canadian energy system. The Reference Case assumes LNG exports from the B.C. Coast start in 2019 and increase by 14 106m³/d (0.5 Bcf/d) per year to reach 71 106m³/d (2.5 Bcf/d) by 2023. The High LNG Case increases LNG exports at a faster pace than in the Reference Case, reaching 113 106m³/d (4.0 Bcf/d) by 2022 and then slowly increasing to 170 106m³/d (6.0 Bcf/d) by 2030. The No LNG Case assumes that no LNG exports occur over the projection period.

- The volumes of LNG exports are assumptions and do not represent the Board’s view on future LNG exports. This assumption enables the analysis of other key outcomes, such as natural gas production, energy demand and macroeconomic projections.

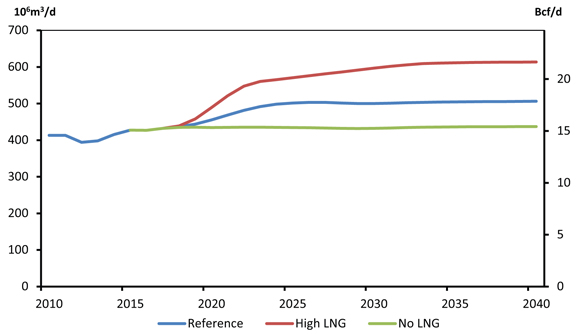

Natural gas production in the High LNG Case is 40 per cent higher than in the No LNG Case in 2040.

- Altering assumed LNG export volumes has substantial impact on the natural gas production projections. As shown in the figure, natural gas production in the Reference Case reaches 506 106m³/d (18 Bcf/d) in 2040, 614 106m³/d (22 Bcf/d) in the High LNG Case, and 437 106m³/d (15 Bcf/d) in the No LNG Case.

Total Natural Gas Production, Reference, High and No LNG Cases

- The natural gas reserves of LNG proponents are largely located in emerging tight and shale natural gas producing regions, many of which are located in B.C. Several proposals have plans to source their natural gas feedstock from the Montney, which is located primarily in Northeast B.C. and extends into Alberta. A recent assessment found that the marketable ultimate potential of natural gas in the Montney was 12 719 109m³ (449 Tcf).

- Date modified: