ARCHIVED - Fact Sheet - Canada's Energy Future: Energy Supply and Demand Projections to 2035 - Report Methodology Overview

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Fact Sheet - Canada's Energy Future: Energy Supply and Demand Projections to 2035 - Report Methodology Overview

Studies such as Canada's Energy Future are part of the National Energy Board's (NEB's) mandate to monitor all aspects of energy supply, transportation and use in Canada. Providing this information is part of the NEB's objective of publicly sharing a view of reasonably foreseeable requirements for energy use in Canada, taking into account trends in oil-and-gas discoveries.

The NEB has a long history dating back to 1967 of providing Canadians with long term energy supply and demand information.

Stakeholder consultation

- In addition to conducting its own quantitative analysis for this report, the NEB sought the views of Canadian energy experts and interested stakeholders representing industry, government, non-governmental organizations and academia. Consultation sessions were held across Canada in May and June 2011 in 12 cities - Edmonton, Yellowknife, Toronto, Ottawa, Montreal, St. John's, Halifax, Fredericton, Winnipeg, Regina, Vancouver and Calgary.

Sensitivity cases

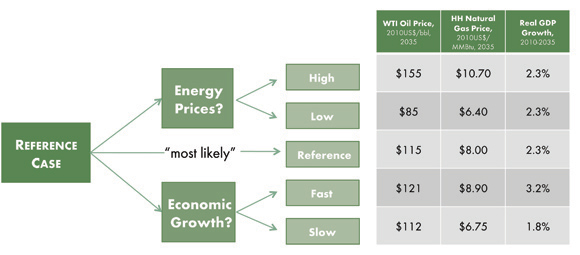

- The 2011 Energy Futures Report employs sensitivity analysis to capture the impact of key uncertainties on the projections of energy supply and demand. Five cases are included in the Report.

- The Reference Case represents the "mostly likely" of the cases, with a moderate view of future energy price and economic growth.

- Four additional “sensitivity cases” are also presented. They are based upon higher and lower crude oil and natural gas prices, and faster and slower growth of the Canadian economy.

Price and GDP Growth to 2035, All Cases

Assumptions underlying the Reference Case

- The West Texas Intermediate (WTI) crude oil price (in constant dollars) is assumed to average US$90/bbl in 2011. The price increases slowly over the projection period, reaching US$115/bbl by 2035.

- The Henry Hub price of natural gas in the Reference Case increases from US$4.50/MMBtu in 2011 to US$8.00/MMBtu in 2035. The increase reflects growing demand and gradually increasing costs of discovering and producing gas.

- Electricity prices are determined in regional markets. In the Reference Case, the average retail electricity price (including residential, commercial and industrial prices) is projected to be 42 per cent higher in 2035 than in 2010, in real terms.

- From 2010 to 2035, annual real GDP growth is projected to average 2.3 per cent.

Report Format

- The report examines key drivers for energy prices and economic growth, provides an energy demand outlook, and examines the outlook for crude oil production, natural gas, natural gas liquids, electricity and coal. In each section key uncertainties to the outlook are provided.

Modeling Framework

- Analysis for the Report is done with an extensive suite of well-developed modeling tools. The energy demand and electricity modeling is completed using the Energy 2020 model, which works in an integrated fashion with an economic model, provided by Informetrica Inc. In addition, several in-house models are involved in projecting oil, natural gas and natural gas liquids production.

- Date modified: