ARCHIVED - Fact Sheet - Canada's Energy Future: Energy Supply and Demand Projections to 2035 - Natural Gas Liquids Outlook Highlights

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Fact Sheet - Canada's Energy Future: Energy Supply and Demand Projections to 2035 - Natural Gas Liquids Outlook Highlights

Canada's Energy Future: Energy Supply and Demand Projections to 2035provides a "most likely" Reference Case and four sensitivity cases (based on high and low prices, and fast and slow economic growth) to 2035. The highlights below are based on the Reference Case. For detailed information, please see page 36 of the report.

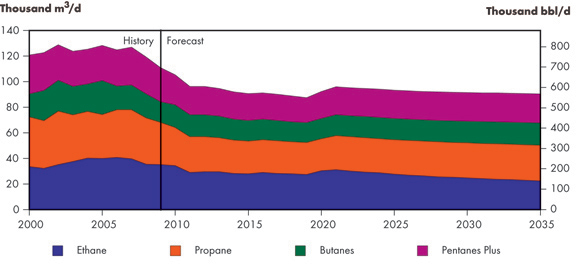

Total NGL production expected to decline

- Raw natural gas as it comes from the wellhead is mostly composed of methane, but also contains various heavier hydrocarbons as well as some contaminants.[1] These heavier hydrocarbons, which consist of ethane, propane, butanes and pentanes plus,[2] are called natural gas liquids or NGLs.

[1] Common contaminants are water, carbon dioxide, and hydrogen sulphide.

[2] Pentanes plus, or condensate, is a gaseous mixture comprised of pentane and heavier hydrocarbons. - In the Reference Case, total Canadian NGL production is expected to decline. A fall in ethane production is the biggest contributor to the declining trend in total NGL production. In general, production of propane, butanes and pentanes plus is expected to decline in the near term but stabilize after 2015, as shown in the figure below.

- In the Reference Case, propane supply declines in the near term due to falling non-tight conventional natural gas production. It starts a slow recovery in 2014 when new natural gas production from Montney and increased off-gas processing increases supply. Domestic demand for propane is projected to grow 0.3 per cent per year over the projection period. Propane available for export is expected to decrease early in the projection period, but stabilize from 2015 onwards.

- Production of butanes in the Reference Case behaves similarly to propane. Production is expected to decline from 2010 to 2015, and then stabilize until a mild recovery in 2021. Butanes demand is expected to grow at 1.7 per cent per year over the projection period, as use of butanes as diluents in oil sands production continues. The combination of growing demand and the decline in butane supply makes Canada a net importer of butanes after 2013.

- Pentanes plus supply is expected to decline early in the Reference Case projection period, and then stabilize from 2020 onwards. Growth in oil sands production will be the main driver of condensate demand. Although some synthetic crude oil could be used for bitumen dilution in the future, bitumen diluent demand is expected to grow at an average rate of 5.7 per cent per year over the projection period, outstripping available domestic supplies. Imports of condensate increase at an average rate of 10 per cent per year over the projection period, reaching 106 thousand m³/d (668 thousand bbl/d) by 2035.

Natural Gas Liquids Production, Reference Case

- Despite the growing availability of ethane in raw gas in the Reference Case, ethane production is expected to decline in the projection. This occurs because gas production growth is largely occurring in British Columbia where ethane extraction capacity is minimal. In Alberta, non-tight conventional production is falling while gas demand is rising. These factors combine to reduce the amount of gas reaching the major ethane extraction facilities located near Alberta's borders.

- Alberta's ethane demand is mostly concentrated in the petrochemical sector. Ethane demand in Alberta has become supply-constrained as ethane supplies have fallen in recent years below the petrochemical capacity. In the absence of other sources such as imports or new indigenous supply, ethane consumption is expected to continue to decline.

- Date modified: