ARCHIVED - Fact Sheet - Canada's Energy Future: Energy Supply and Demand Projections to 2035 - Emerging Fuels and Energy Efficiency Highlights

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Fact Sheet - Canada's Energy Future: Energy Supply and Demand Projections to 2035 - Emerging Fuels and Energy Efficiency Highlights

Canada's Energy Future: Energy Supply and Demand Projections to 2035 provides a "most likely" Reference Case and four sensitivity cases (based on high and low prices, and fast and slow economic growth) to 2035. The highlights below are based on the Reference Case and were selected from various sections of the report.

Canadian electricity supply becomes cleaner

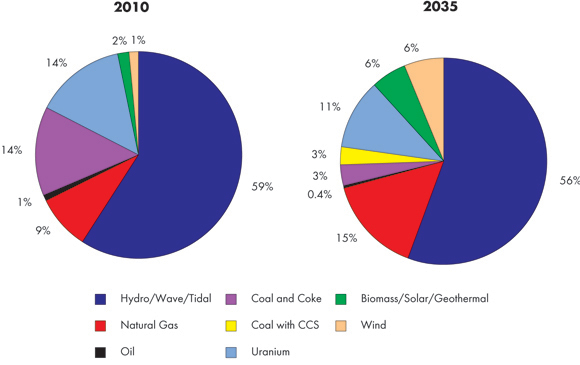

- The projected changes in generation mix (see figure below) reflect government and industry efforts to curb energy-related green house gas (GHG) emissions and take into account announced provincial energy strategies, utility expansion plans, and the relative economics of generation options.

- Canadian electricity supply becomes cleaner over the projection period, as the share of non-CO2-emitting generation sources (such as nuclear, renewable and plants with carbon capture and storage technology) increases from 76 per cent in 2010 to 79 per cent in 2035. The share of renewable-based generation increases from 62 per cent in 2010 to 68 per cent in 2035.

Canadian Generation Mix in 2010 and 2035, Reference Case

Use of renewable resources to grow

Renewable resources

- Canada has significant non-hydro renewable resources for electricity generation, including wind, biomass, solar, tidal and wave power. These technologies have grown in the last few years, despite challenges relating to availability and cost. Policy and incentives have helped their growth, such as Ontario's feed-in tariff.

- Wind power has experienced strong growth in recent years. Over the projection period, it makes the largest contribution to non-hydro renewable growth. The availability of large hydro storage capacity in Canada facilitates the development of wind power as hydro may be used as a back-up source of power when intermittent wind resources are not available.

Hydro electricity

- Canada is a world leader in hydroelectricity generation. Hydroelectricity will remain a dominant source of electricity supply in Canada over the projection period. It has the advantages of being a flexible, low-cost source of non-CO2 emitting base load electricity, which contributes to maintaining stable electricity prices. [1]

[1] Hydro power is flexible in the sense that the output from hydro generating stations can be adjusted quickly with variations in demand. This is often referred to as the load-following characteristic of hydro power. Hydro power can contribute to maintaining price stability because it is not subject to volatility of fuel costs.

Declining use of coal

- A key feature of the electricity supply outlook is the declining role of coal used in power generation. This trend reflects various government and industry initiatives to limit GHGs, including stricter regulation of GHG emissions from large industrial polluters such as coal-fired power plants and the planned complete phase-out of coal in power generation in Ontario. In addition to renewable and hydro generation capacity, natural gas-fired plants are expected to replace retired coal-fired power plants.

Canadians strive for energy efficiency

Vehicle energy efficiency

- In late 2010, the federal government finalized regulations for light duty vehicle emissions. The Passenger Automobile and Light Truck Greenhouse Gas Emission Regulations set progressively more stringent limitations on tailpipe emissions for new vehicles in the 2012 to 2016 timeframe.

- The regulation is based on manufacturers' fleet make-up from 2011. It is expected that a large portion of the emissions reductions will coincide with an improvement in fuel economy, which will put downward pressure on vehicle energy demand.

Energy efficiency in buildings

- An extensively revised National Energy Code for Buildings (NECB) was finalized in the spring of 2011. This companion to the National Building Code puts a greater emphasis on energy performance in buildings than in the past. The code change is expected to improve energy performance in new commercial, institutional, and multi-unit residential complexes by 25 per cent over the previous code (1997).

- Demand management programs and policies contribute to the low energy demand growth in the residential sector. Federal programs, such as the ecoEnergy Retrofit-Homes program, have been employed with various provincial programs. Space heating energy efficiency will benefit from new federal regulations for furnaces and boilers. In 2009 and 2010, amendments to the federal Energy Efficiency Act have increased minimum energy performance standards for more than a dozen home devices. There has also been a renewed commitment for utility-based demand side management (DSM) programs.

- All provinces and territories have voluntary programs encouraging greater energy efficiency in new homes and equipment. Many of these programs offer incentives to consumers such as rebates, low-interest loans, and education and awareness campaigns. Also, several provinces have recently moved forward with building codes that include more stringent minimum energy performance standards.

- Date modified: