Market Snapshot: New projects in Alberta could add significant carbon storage capacity by 2030

Connect/Contact Us

Please send comments, questions, or suggestions for Market Snapshot topics to snapshots@cer-rec.gc.ca

Release date: 2022-12-21

Carbon capture and storageFootnote 1 (CCS)Definition* has become an important option to reduce Alberta’s greenhouse gasDefinition* emissions. Two carbon capture projects, Quest and Alberta Carbon Trunk Line or ACTL,Footnote 2Footnote 3 were commissioned in 2015 and 2020 respectively, increasing Alberta’s carbon storage capacityFootnote 4 to 3.0 million tonnes of carbon dioxide (CO2) per year (Mt CO2/year) by the end of 2022.

Upcoming CCS projects in Alberta

A new wave of provincial CCS projects are proposed. In MarchFootnote 5 and OctoberFootnote 6 2022, the Alberta government selected a total of 25 new CCS projects for further evaluation. Of these, sevenFootnote 7 new projects, with known capacity and commissioning dates plus expansions of already existing projects, have the potential to increase the provincial CCS capacity to about 56 million tonnes of (carbon dioxide) CO2 per year by 2030Footnote 8 (Table 1). This is equivalent to 22% of the 256.5 million tonnes of CO2 emissions in Alberta in 2020.Footnote 9 The remaining 18 projectsFootnote 10 would further increase future provincial carbon capture capacity if completed. However, CCS projects require large investments and take a long time to build. Which projects eventually get built, and when, will depend on availability of labour, material, financing, and government policies.

Table 1: Alberta’s current and proposed CCS projects

| Project | Status | Start Up | CO2 Sequestration Capacity (Mt CO2/year) |

Capture | Transport | Sequestration | UtilizationTable Note a | Partners | Carbon Hub |

|---|---|---|---|---|---|---|---|---|---|

| Joffre | In service | 1984 | 0.04 | ✗ | ✗ | ✗ | ✗ | Whitecap Resources | |

| Chigwell | In service | 2005 | 0.06 | ✗ | ✗ | ✗ | ✗ | AlphaBow Energy | |

| Quest | In service | 2015 | 1.20 | ✗ | ✗ | ✗ | Shell Canada (operator), AOSP Joint Venture | ||

| Hays | In service | 2016 | 0.01 | ✗ | ✗ | ✗ | ✗ | Canadian Natural Resources (CNRL) | |

| Alberta Carbon Trunk Line (ACTL) | In service | 2020Table Note b | 1.60 | ✗ | ✗ | ✗ | ✗ | Wolf Midstream, Enhance Energy, Nutrien, NWR Sturgeon Refinery | ✗ |

| Glacier (Phase 1) | In service | 2022 | 0.05 | ✗ | ✗ | ✗ | Advantage EnergyTable Note d | ||

| Glacier (Phase 1B & 2) | Proposed | H2 2023 | 0.15 | ✗ | ✗ | ✗ | Advantage Energy | ||

| Origins Project | Proposed | 2024 | ✗ | Enhance EnergyTable Note c | ✗ | ||||

| Proposed Carbon Hub (East of Edmonton) | Proposed | End-2024 | 2.00 | ✗ | ✗ | Wolf Midstream, Whitecap Resources, First Nations Capital Investment Partnership, Hearth Lake First Nation | ✗ | ||

| Alberta Carbon Grid | Proposed | 2025 | 20.00 | ✗ | ✗ | Pembina Pipeline Corp., TC Energy Corp. | ✗ | ||

| Wabamun Carbon Hub | Proposed | 2025 | 4.00 | ✗ | ✗ | ✗ | Enbridge, Capital Power Corporation (Capital Power), Lehigh Cement and Indigenous partners | ✗ | |

| Atlas Carbon Sequestration Hub (Phase 1) | Proposed | Mid-2020s | 0.75 | ✗ | ✗ | ✗ | Shell Canada, ATCO Energy Solutions, Suncor Energy Inc.Table Note e | ✗ | |

| Meadowbrook Hub Project | Proposed | 2027 | 3.00 | ✗ | ✗ | Bison Low Carbon Ventures Inc., Enerflex Ltd., PrairieSky Royalty Ltd. and IRC Enterprises Inc. | |||

| Alberta Carbon Trunk Line (ACTL) | Planned | 2030Table Note f | 13.00Table Note g | ✗ | ✗ | ✗ | ✗ | Wolf Midstream, Enhance Energy. | ✗ |

| Oil Sands Pathways to Net Zero | Proposed | 2030 | 10.00 | ✗ | ✗ | ✗ | Patways Alliance (CNRL, Imperial Oil, Cenovus, MEG Energy, Suncor, ConocoPhillips) | ✗ | |

| 2022 Carbon Sequestration Capacity | |||||||||

| Quest & ACTL | 2.80 | ||||||||

| Total Operational | 2.96 | ||||||||

| 2030 Estimated Incremental Sequestration Capacity | 52.90 | ||||||||

| 2030 Estimated Total Sequestration Capacity | 55.86 | ||||||||

|

Sources: BOE Report, Alberta Energy, Alberta Energy Regulator (AER), Hares, R. (2020). Feasibility of CCUS to CO2-EOR in Alberta (Unpublished master's project), University of Calgary, Calgary, AB., Entropy, CNRL, Shell Canada, Whitecap Resources, Enhance, Wolf Midstream, Alberta Innovates, Pathways Alliance, McDaniel & Associates. |

|||||||||

Sources and Description

Sources: BOE Report, Alberta Energy, Alberta Energy Regulator (AER), Hares, R. (2020). Feasibility of CCS to CO2-EOR in Alberta (unpublished master's project), University of Calgary, Entropy, CNRL, Shell Canada, Whitecap Resources, Enhance, Wolf Midstream, Alberta Innovates, Pathways Alliance, McDaniel & Associates.

Description: This table displays the information available as of 31 October 2022 for each CCS project in Alberta, the name, status, startup date, existing and proposed carbon dioxide sequestration capacity, whether the project includes carbon capture, transportation, sequestration, and utilization, whether the project is a carbon hub, and project partners. Most of the carbon hub projects do not include CO2 capture facilities, but all of them will offer open access to third parties to connect their CO2 capture facilities to the hub. Capacity is expressed in million metric tonnes of CO2 per year.

CCS in Alberta

CCS involves capturing carbon dioxide from industrial emitters, compressing it into liquid state, transporting it, and injecting it into sites deep underground. In the case of carbon capture, utilization and storage (CCUS)Definition*, when injected underground, it can be used for enhanced oil recovery (EOR)Definition* or as feedstockDefinition* for industrial uses.Footnote 11Footnote 12

Alberta’s producers have been injecting CO2 for EOR since early 1980s. Volumes injected gradually increased to 0.28 million tonnes of CO2 per year in 2014, before more than doubling to 0.61 million tonnes of CO2 per year in 2015 with the startup of the Quest project. CO2 volumes continued to grow in the following years before a steep increase in 2020 to 2.12 million tonnes of CO2 per year, thanks to the commissioning of the Alberta Carbon Trunk Line (ACTL). Volumes reached 3.17 million tonnes of CO2 per year in 2021 (Figure 1).

Figure 1: Historical Alberta CO2 well injections

Source and Description

Source: Divestco

Description: This area chart shows the annual volumes of carbon dioxide injected underground in Alberta for EOR and storage from 1983 to 2021. In both cases, CO2 injected remains permanently stored underground. Data is broken down showing volumes stored by the Quest, ACTL and other projects. Conversion factor from volume of carbon dioxide to mass is one tonne CO2 = 542.6 cubic metres CO2. Numbers may not add up due to rounding.

New Proposals for Albertan CCS projects designed as carbon hubs

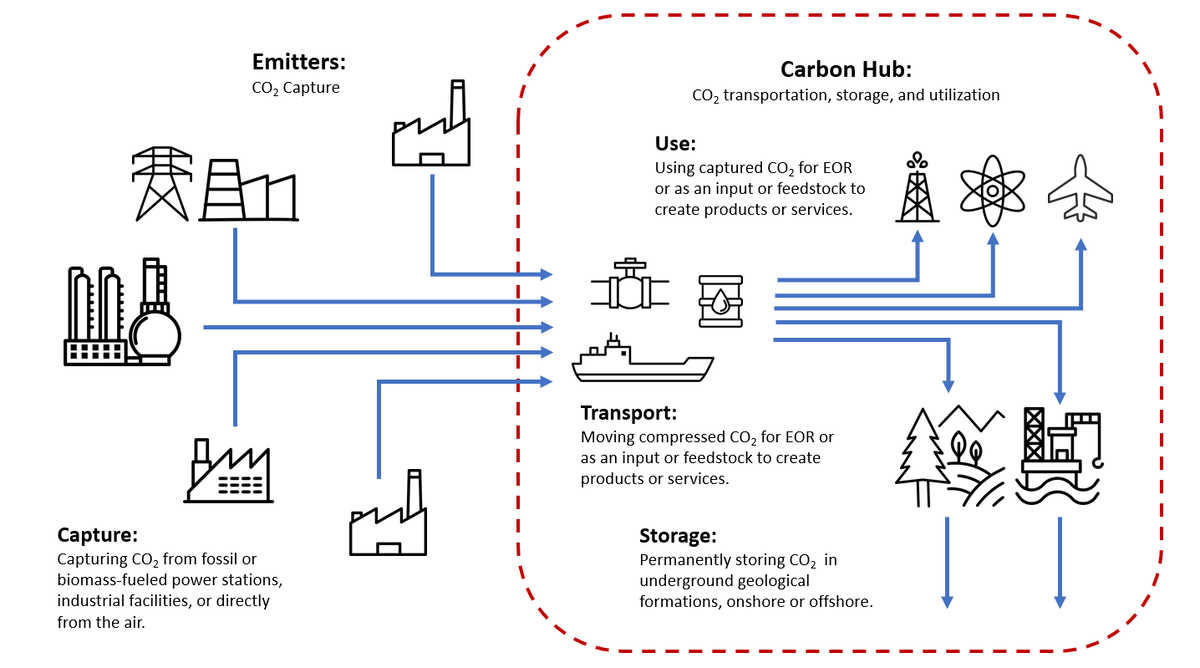

In the past, Alberta CCS projects were integrated projects (capture, transportation, and storage/utilization). Integrated projects are still proposed when the availability of local infrastructure that could be repurposed for carbon storage make it feasible. But, starting with the ACTL, the new Albertan carbon storage projects are being conceived as open-access carbon hubs,Definition* separating CO2 capture, transportation, and storage services to reduce cost and improve access to large scale CO2 transportation and storage. This separation would benefit large and small greenhouse gas emitters like refineries, upgraders, hydrogen-producing facilities,Footnote 13 power plants, gas plants, and fertilizer facilities (Figure 2). Some proposed carbon hub projects, like Origins (see Table 1), would connect to existing CO2 pipelines. Others, like Alberta Carbon Grid, Wabamun, and Atlas also include CO2 transportation. However, as provincial and Canadian CCS evolves, CCS implementation would vary to cater to different emitters’ needs.

Figure 2: Carbon Hub

Sources and Description

Sources: IEA, CER

Description: This diagram shows the main elements of a carbon capture and storage value chain, and what parts are included in a carbon hub (transportation, storage, and utilization).

Oversight on CCS

In addition to Alberta's existing oil and gas regulations applying to CCS, the province has enacted a regulatory frameworkFootnote 14 for CCS development, as well as support programs to foster developing CCS technologies and their safe and effective use:

- Alberta Energy issues evaluation permits, agreements, and leases for carbon sequestration in the provinceFootnote 15Footnote 16Footnote 17Footnote 18

- The Alberta Energy Regulator (AER) regulates the facilities that capture, transport, and inject CO2 into underground reservoirsFootnote 19.

- Alberta’s Industrial Energy Efficiency, Carbon Capture Utilization and Storage Grant ProgramFootnote 20 offers funding to support CCS and industry energy efficiency projects.

- Government of Alberta CCS Funding Agreement (Quest and ACTL)Footnote 21.

The International Energy Agency (IEA) has repeatedly emphasized the value of CCS as one of the main tools to fight climate change. Natural Resources Canada is leading the development of a CCS federal strategy.Footnote 22Footnote 23 In July 2022, the ministers of Natural Resources Canada and Environment and Climate Change Canada released a discussion paperFootnote 24 and opened consultations for establishing a new commitment for capping and cutting emissions from the oil and gas sector. The discussion paper considers CCS as one of the six key decarbonization options available for the Canadian oil and gas sector.

- Date modified: