Provincial and Territorial Energy Profiles – Newfoundland and Labrador

On this page:

Connect/Contact Us

Please send comments, questions, or suggestions to

energy-energie@cer-rec.gc.ca

-

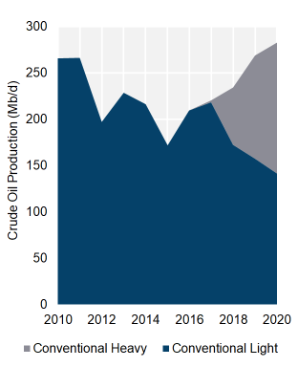

Figure 1: Hydrocarbon Production

Source and Description:

Source:

CER – Estimated Production of Canadian Crude Oil and Equivalent and Marketable Natural Gas Production in CanadaDescription:

This graph shows hydrocarbon production in Newfoundland and Labrador from 2013 to 2023. Over this period, crude oil production has decreased from 229 Mb/d to 200 Mb/d. -

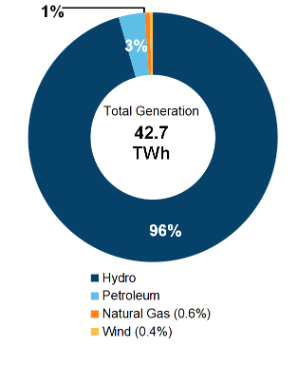

Figure 2: Electricity Generation by Fuel Type (2021)

Source and Description:

Source:

CER – Canada's Energy Future 2023 Data Appendix for Electricity GenerationDescription:

This pie chart shows electricity generation by source in Newfoundland and Labrador. A total of 41.9 TWh of electricity was generated in 2021. -

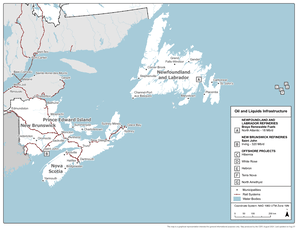

Figure 3: Crude Oil Infrastructure Map

Source and Description:

Source:

CERDescription:

This map shows refineries and offshore crude oil platforms in Newfoundland and Labrador, and crude oil infrastructure in Atlantic Canada.Download:

PDF version [2,817 KB] -

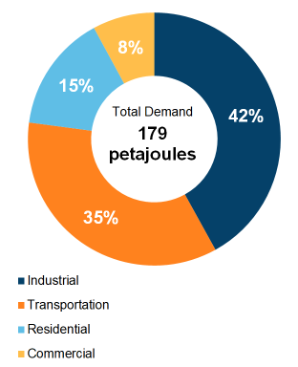

Figure 4: End-Use Demand by Sector (2020)

Source and Description:

Source:

CER – Canada's Energy Future 2023 Data Appendix for End-Use DemandDescription:

This pie chart shows end-use energy demand in Newfoundland and Labrador by sector. Total end-use energy demand was 148 PJ in 2020. The largest sector was industrial at 40% of total demand, followed by transportation (at 33%), residential (at 17%), and lastly, commercial (at 10%). -

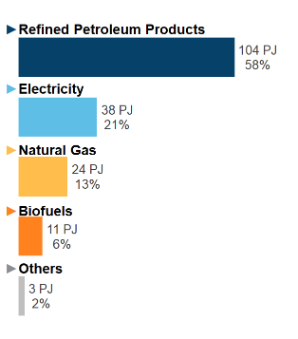

Figure 5: End-Use Demand by Fuel (2020)

Source and Description:

Source:

CER – Canada's Energy Future 2023 Data Appendix for End-Use DemandDescription:

This figure shows end-use demand by fuel type in Newfoundland and Labrador in 2020. Refined petroleum products accounted for 76 PJ (51%) of demand, followed by electricity at 37 PJ (25%), natural gas at 22 PJ (15%), biofuels at 11 PJ (7%), and other at 3 PJ (2%).

Note: "Other" includes coal, coke, and coke oven gas. -

Figure 6: GHG Emissions by Sector

Source and Description:

Source:

Environment and Climate Change Canada – National Inventory Report 1990-2022Description:

This stacked column graph shows GHG emissions in Newfoundland and Labrador by sector from 1990 to 2022 in MT of CO2e. Total GHG emissions have increased in Newfoundland and Labrador from 9.5 MT of CO2e in 1990 to 8.6 MT of CO2e in 2022. -

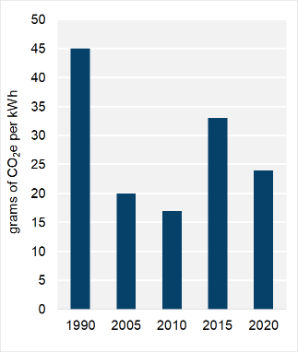

Figure 7: Emissions Intensity of Electricity Generation

Source and Description:

Source:

Environment and Climate Change Canada – National Inventory Report 1990-2022Description:

This column graph shows the emissions intensity of electricity generation in Newfoundland and Labrador from 1990 to 2022. In 1990, electricity generated in Newfoundland and Labrador emitted 45 g of CO2e per kWh. By 2022, emissions intensity decreased to 17 g of CO2e per kWh.

Energy Production

Crude Oil

- In 2023, Newfoundland and Labrador’s oil production was 200.1 thousand barrels per day (Mb/d), or 4% of Canada’s overall production and 12% of Canada’s conventional light oil production. (Figure 1).

- Newfoundland and Labrador is the largest producer of crude oil in eastern Canada, and is the third largest oil producing province in Canada, after Alberta and Saskatchewan.

- Production occurs from five offshore fields: Hibernia, Terra Nova, White Rose, North Amethyst, and Hebron. All five fields are in the Jeanne d’Arc Basin.Footnote 1

- Light oil production at the ExxonMobil-operated Hibernia oil platform was 68.0 Mb/d in 2023, a 9% decrease from 2022. Hibernia is a joint venture between ExxonMobil Canada, Chevron Canada Resources, Suncor Energy, Canada Hibernia Holding Corporation, Murphy Oil, and Equinor Canada Ltd. In addition, the Hibernia Southern Extension (HSE), a subsea development of wells with connections to the Hibernia platform, is owned and operated by the same group of companies as well as a provincial Crown corporation, Newfoundland and Labrador Hydro (NL Hydro). The Oil and Gas Corporation of Newfoundland and Labrador (OilCo) manages an 8.7% participating interest in HSE on behalf of NL Hydro.

- Suncor Energy operates the Terra Nova field, about 350 kilometers (km) southeast of Newfoundland. Terra Nova stopped producing oil in December 2019, following an order by the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) to suspend production-related operations.Footnote 2 In September 2021, Suncor Energy and other Terra Nova owners finalized the Asset Life Extension Project.Footnote 3 The project is expected to extend production by 10 years and recover an additional 70 million barrels of oil. In November 2023, the Terra Nova FPSO (floating production, storage, and offloading) vessel restarted following the completion of the Asset Life Extension Project.Footnote 4 Terra Nova is owned by Suncor Energy, Cenovus Energy, and Murphy Oil.

- In 2023, the White Rose and North Amethyst fields produced an average 13.3 Mb/d to the SeaRose FPSO vessel, a 27% decrease from 2022. The SeaRose FPSO vessel stopped production in January 2024 and sailed to Belfast, Northern Ireland, where the vessel is undergoing a refit as part of the White Rose Asset Life Extensions (ALE) project. Production at the White Rose field is expected to restart in the third quarter of 2024. The White Rose and White Rose Expansion projects, which include development of these fields, are owned and managed by Cenovus Energy, Suncor Energy, and NL Hydro.

- The West White Rose project was intended to develop additional light crude oil reserves and extend the life of the White Rose oil field. Construction was halted in March 2020 in response to COVID-19 but was restarted in May 2022 after ownership restructuring and an amended royalty structure was established with the provincial government.Footnote 5 The project is expected to be in-service in 2026.

- Production at the Hebron oil platform averaged 117.6 Mb/d in 2023, a 15% decrease from 2022. The Hebron oil platform first produced oil in November 2017. Hebron produces heavy oil and is a joint venture among ExxonMobil Canada, Chevron Canada Resources, Suncor Energy, Equinor Canada Ltd., and NL Hydro.

- Equinor is proposing to develop the Bay du Nord project in the Flemish Pass Basin,Footnote 6 about 500 kilometres from St. John’s, in approximately 1,170 metres of water. This would be Canada’s first deepwater development to produce oil. Several recent discoveries have improved the potential recoverable oil resources for the project. In February 2023, the C-NLOPB issued a significant discovery licence (SDL) to Equinor related to the Cappahayden well,Footnote 7 and a year later in February 2024, one for the Cambriol discovery.Footnote 8 The Cappahayden and Cambriol wells are estimated to hold recoverable reserves of 385 million barrels and 340 million barrels, respectively. In May 2023, Equinor announced that the project would be postponed up to three years.

- The Canada-Newfoundland and Labrador Offshore Petroleum BoardFootnote 9 is the independent regulatory agency created in 1986 under the Atlantic Accord Implementation Acts with a mandate that includes offshore safety, environmental protection, resource management and industrial benefits. In April 2022, the Government of Canada announced that the C-NLOPB would expand its mandate to include the regulation of offshore renewable energy development, and that it would be renamed to the Canada-Newfoundland and Labrador Offshore Energy Board (C-NLOEB) to reflect its new mandate.Footnote 10

Refined Petroleum Products (RPPs)

- The refinery in Come by Chance is the only refinery in the province. It first opened in 1973 and underwent several ownership changes through the years. Prior to 2020, the refinery had the capacity to refine up to 130 Mb/d of crude oil. The refinery closed in April 2020 and was converted to the Braya Renewable Fuels refinery under new ownership.

- Prior to the idling of the refinery in Come by Chance, Newfoundland and Labrador had a net surplus of RPPs and exported a significant amount of its production to the United States (U.S.) East Coast market.

Renewable Fuels

- The Braya Renewable Fuels refinery in Come by Chance was converted from an oil refinery to a biofuels refinery between 2021 and 2023. In February 2024, the facility commenced commercial operations with an initial production capacity of 18 Mb/d of renewable diesel. Feedstocks used for fuel production include tallow, soybean oil, distiller’s corn oil, canola oil, and used cooking oil.Footnote 11 Feedstock is imported from all over the world. In the future, Braya plans to expand production capacity, produce sustainable aviation fuel, and explore green hydrogen production.Footnote 12

Natural Gas/Natural Gas Liquids (NGLs)

- In 2023, Newfoundland and Labrador produced 410 million cubic feet per day (MMcf/d) of natural gas at its crude oil facilities offshore of Newfoundland.Footnote 13 This gas is used to generate power on offshore facilities or is reinjected underground to maintain reservoir pressure or increase oil production. Small amounts may be flared.

- A small amount of NGLs are included with oil production, but there is no commercial production of NGLs in Newfoundland and Labrador.

- Newfoundland and Labrador’s natural gas resource is estimated by Canada Newfoundland and Labrador Offshore Petroleum Board at 10.7 trillion cubic feet.

- In 2013, the Newfoundland and Labrador government announced that it would no longer accept applications for hydraulic fracturing.

Electricity

- In 2021, Newfoundland and Labrador generated 41.9 terawatt-hours (TWh) of electricity (Figure 2), which is approximately 7% of total Canadian generation. Newfoundland and Labrador is the fifth largest producer of electricity in Canada and has an estimated generating capacity of 8,682 megawatts (MW).

- Newfoundland and Labrador generates 97% of its electricity from hydroelectric sources. This includes the 5,428 MW Churchill Falls generating station,Footnote 14 which is one of the largest power plants in Canada. Newfoundland and Labrador HydroFootnote 15 owns 65.8% of the project and Hydro-QuébecFootnote 16 owns the remaining 34.2%. Most of the energy from Churchill Falls is sold to Hydro-Québec under a long-term contract that expires in 2041.

- Newfoundland and Labrador Hydro’s Lower Churchill project involves construction of two hydro generation facilities: Muskrat Falls (824 MW) and Gull Island (2,250 MW). The Muskrat Falls Generating Station was commissioned in late 2021. The Gull Island project, still in the proposal stage, has not yet been sanctioned for construction.

- After hydroelectricity, oil is the second largest contributor to Newfoundland and Labrador’s electricity capacity. Although oil accounted for 9% of the province’s electricity capacity, it only made up 2% of the generation mix in 2021. Natural gas and wind power also contribute a small proportion to the generation mix.

- The 490 MW oil-fired Holyrood Thermal Generating Station was once scheduled for shutdown in 2021 after the completion of Muskrat Falls, but Holyrood is now expected to remain operating until 2030. The generating station now primarily operates as a backup facility, generating electricity only during periods of high demand.Footnote 17

- Newfoundland and Labrador Hydro is responsible for most power generation in the province. There are also independent power producers of hydroelectricity, cogeneration, wind, and biogas.

Wind-Hydrogen

- In April 2022, Newfoundland and Labrador lifted a 15-year moratorium on onshore wind farms.Footnote 18

- In February 2023, Newfoundland and Labrador announced a new Wind-Hydrogen Fiscal Framework.Footnote 19 The Framework is intended to provide a predictable and transparent fiscal system to inform investment decisions and resource development for wind-hydrogen projects in the province.

- In August 2022, Newfoundland and Labrador announced a call for bids for Crown land for wind energy development. In August 2023, it was announced that four companies were selected to receive wind application recommendation letters, which provided the right to pursue the development of their projects.Footnote 20 An environmental assessment will be required for these projects.

- Argentia Renewables Wind LP (Pattern), a 100% owned affiliate of Pattern Energy, is proposing a 300-megawatt wind-hydrogen project located at the Port of Argentina.Footnote 21 The project is currently completing environmental studies and acquiring regulatory approvals, with a target construction date of 2025 and a target project operations date of 2027.

Energy Transportation and Trade

Crude Oil and Liquids

- There are no crude oil pipelines or crude-by-rail facilities in Newfoundland and Labrador.

- Newfoundland and Labrador is the only province that produces offshore crude oil. All offshore crude oil production is transported to Newfoundland Transshipment Limited’sFootnote 22 3.3 million barrel capacity terminal located in Whiffen Head in Placentia Bay. The terminal received its first delivery from the Hibernia field in October 1998. Crude is then loaded onto ships destined for domestic and export markets (Figure 3).

Natural Gas

- There are no natural gas pipelines in Newfoundland and Labrador.

Liquefied Natural Gas (LNG)

- The Placentia Bay LNG export project is in the early proposal stages.Footnote 23 The LNG project would involve building a central gas hub near the five oil-producing fields in the Jeanne d'Arc Basin and a 600 km subsea pipeline to Grassy Point in Placentia Bay. The proponent, LNG Newfoundland and Labrador Limited, registered the project in 2021 with the Government of Newfoundland’s Department of Environment and Climate Change Environmental Assessment Division.

Electricity

- Newfoundland and Labrador is a significant net exporter of electricity. In 2023, net interprovincial and international electricity outflows accounted for 34.5 TWh.

- The largest recipient of Newfoundland and Labrador’s electricity is Quebec. Approximately 90% of the power generated at Churchill Falls flows to Quebec and neighbouring markets in Canada and the U.S. through long-term power purchase agreements.

- Newfoundland and Labrador’s transmission system,Footnote 24 until recently, consisted of two large networks: the Island Interconnected System, which was isolated from the rest of North America, and the Labrador Interconnected System, which receives hydro power from the Churchill Falls station and connects to Quebec’s infrastructure. Since 2018, the island of Newfoundland is now connected to the North American power grid through the construction of the Labrador-Island Link and the Maritime Link.

- Construction on the Labrador-Island LinkFootnote 25 was completed in late 2017 and commissioned in April 2023.Footnote 26 The project consists of a 1,100 km transmission line that carries electricity from the Muskrat Falls generating facility in Labrador to the island of Newfoundland.

- The Maritime LinkFootnote 27 was also completed in late 2017 and the line was in service in January 2018. Two subsea cables connect the island of Newfoundland with Nova Scotia and allow access to the North American bulk electric system. The Maritime Link also allows Nova Scotia to receive 20% of the power originating from Muskrat Falls through a fixed rate 35-year agreement. First power from Muskrat Falls to Nova Scotia began in August 2021.Footnote 28

- Newfoundland Power,Footnote 29 a subsidiary of Fortis Inc., is the primary distributor of electricity in the province, serving more than 275,000 customers. Newfoundland Power operates 11,500 km of distribution lines on the island portion of the province.

- Newfoundland and Labrador Hydro distributes power to the remaining 38,000 rural customers, across more than 7,500 km of transmission and distribution lines.Footnote 30 The Newfoundland and Labrador System Operator is responsible for the provincial electricity system in real-time.Footnote 31

- There are also isolated systems serving 20 communities along the coast of the province. These isolated systems are primarily supported by diesel generation.

- Newfoundland and Labrador’s Board of Commissioners of Public UtilitiesFootnote 32 regulates both Newfoundland and Labrador Hydro and Newfoundland Power.

Energy Consumption and Greenhouse Gas (GHG) Emissions

Total Energy Consumption

- End-use demand in Newfoundland and Labrador was 148 petajoules (PJ) in 2020. The largest sector for energy demand was industrial at 40% of total demand, followed by transportation at 33%, residential at 17%, and commercial at 10% (Figure 4). Newfoundland and Labrador’s energy demand was the ninth largest in Canada, and the fourth largest on a per capita basis.

- Refined petroleum products had the highest consumption in Newfoundland and Labrador, accounting for 76 PJ, or 51% of total end-use demand. Electricity and natural gas accounted for 37 PJ (25%) and 22 PJ (15%), respectively (Figure 5).

Refined Petroleum Products

- Newfoundland and Labrador’s motor gasoline demand in 2022 was 1,409 litres per capita, 36% above the national average of 1,035 litres per capita.

- Newfoundland and Labrador’s diesel demand in 2022 was 875 litres per capita, 13% above the national average of 772 litres per capita.

- RPPs consumed in Newfoundland and Labrador are also supplied by the Irving Oil Refinery in New Brunswick, refineries in Quebec, and international imports.

- RPP prices have been regulated by the Newfoundland and Labrador Board of Commissioners of Public Utilities since 2004.Footnote 33 The Board sets maximum retail prices for heating oil, gasoline, and diesel using spot market pricing and adding wholesale and retail margins, transportation costs, and taxes. Prices are revised every week or as required to adjust for market conditions.

Natural Gas

- None of the natural gas produced at offshore oil facilities is sold. The natural gas is used to power the offshore crude oil facilities, reinjected into the ground to maintain reservoir pressure, or flared.

Electricity

- In 2020, annual electricity consumption per capita in Newfoundland and Labrador was 19.6 megawatt-hours (MWh). Newfoundland and Labrador ranked second in Canada for per capita electricity consumption and consumed 34% more than the national average.

- Newfoundland and Labrador’s largest consuming sector for electricity in 2020 was residential at 4.2 TWh. The industrial and commercial sectors consumed 3.6 TWh and 2.5 TWh, respectively.

GHG Emissions

- Newfoundland and Labrador’s GHG emissions in 2022 were 8.6 megatonnes (MT) of carbon dioxide equivalent (CO2e).Footnote 34 Newfoundland and Labrador’s emissions have decreased 9% since 1990 and 16% since 2005.

- Newfoundland and Labrador’s emissions per capita are 16.2 tonnes CO2e per capita, which is 11% below the Canadian average of 18.2 tonnes per capita.

- The largest emitting sectors in Newfoundland and Labrador are transportation at 43% of emissions, industry and manufacturing at 17%, and oil and gas at 15% (Figure 6).

- Newfoundland and Labrador’s GHG emissions from the oil and gas sector in 2022 were 1.29 MT CO2e. Of this total, 1.26 MT were attributable to offshore oil production and 0.03 MT were attributable to petroleum refining.

- In 2022, Newfoundland and Labrador’s power sector emitted 0.7 MT CO2e emissions, which represents about 1% of Canada’s GHG emissions from power generation.

- The greenhouse gas intensity of Newfoundland and Labrador’s electricity grid was 17 grams of CO2e per kilowatt-hour (g of CO2e per kWh) electricity generated in 2022. This is a 15% decrease from the province’s 2005 level of 20 g of CO2e per kWh. The national average in 2022 was 100 g of CO2e per kWh (Figure 7).

Energy Authorities

- Canada-Newfoundland & Labrador Offshore Petroleum Board

- Newfoundland and Labrador Department of Industry, Energy and Technology

- Newfoundland and Labrador Department of Finance: Oil Economic Bulletin

- Board of Commissioners of Public Utilities: Current Regulated Fuel Prices

- Newfoundland and Labrador Hydro: Our Electricity System

- Newfoundland and Labrador Open Data: Energy

- CER–Canada's Renewable Power: Newfoundland and Labrador

- Date modified: