ARCHIVED – Canadian Refinery Overview 2018 – Energy Market Assessment

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Crude Oil Receipts and Refining Capacity

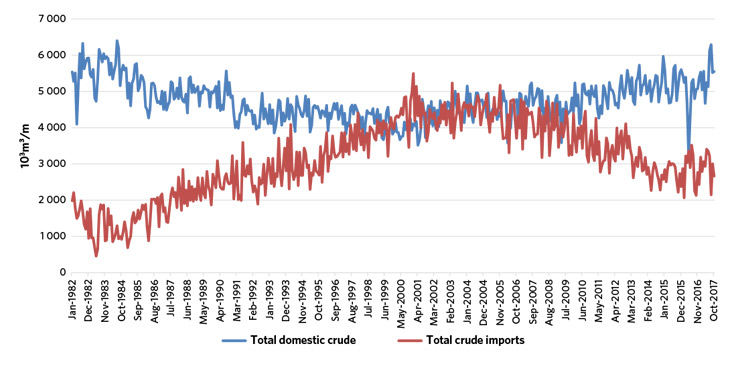

A refinery purchases crude oil to consume in its refinery or to store for later use. These are crude oil receipts. Between 1982 and 2004, refinery receipts of imported crude oil grew, while domestic crude oil receipts declined. During this time, the refining profit from running offshore crude oil rather than domestic crude oil was favourable. That meant that many of the refineries in Canada were importing crude oil. In 2005, this started to change. Imports began to fall and domestic crude oil volumes rose slightly. (Figure 5) In 2010, this trend became more pronounced because the difference in the cost of North American crude oil and offshore crude oil was significant. The closure of refineries in central and Atlantic Canada that imported crude oil, the economic use of rail to transport discounted domestic crude oil and the re-reversal of Line 9 also contributed to this trend.

Figure 5: Crude Supply to Canadian Refineries

Source: CANSIM 134-0001

Description:

This chart breaks down Canadian refinery receipts by domestic and imported crude oil. Between 1982 and 2000, refineries processed primarily domestic crude. Between 2000 and 2009 refineries processed roughly equal amounts of domestic and foreign crude. After 2009, the trend has been an increase in domestic receipts of crude, at the expense of imported crude.

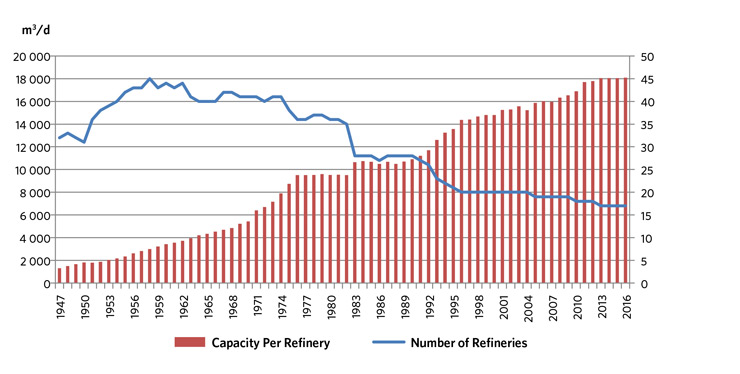

Refining Capacity

Between 2005 and 2013, three refineries closed in central and Atlantic Canada: Imperial Oil Dartmouth (2013), Shell Montreal (2010), and Petro-Canada Oakville (2005). While the ageFootnote 1 and complexity of those refineries were factors, changing environmental regulations for gasoline, overall declining demand for RPPs, and higher crude oil costs for eastern refineries have led to a broader, long-term trend of smaller refineries closing and consolidating in favour of larger, more complex ones.

Despite a decline in the number of total refineries, the average capacity per refinery in Canada has increased. This indicates that consolidation has resulted in larger refineries and greater efficiencies. The average capacity per refinery in 2016, reached 18 103m3/d (114 Mb/d) – an all-time high. (Figure 6)

There had been no new refineries built in Canada in 30 years. However, in late 2017, the Sturgeon Refinery located northeast of Edmonton began operations.

Figure 6: Average Capacity per Refinery vs Number of Refineries

Source: CAPP

Description:

This graph shows that Canadian refineries have gotten more efficient over time. The total number of individual refineries decreased steadily since 1958, while the average capacity per refinery steadily increased. The average capacity per refinery in 2016, reached 18 103m3/d (114 Mb/d).

Sturgeon Refinery

The Sturgeon Refinery, located northeast of Edmonton, is owned and operated by North West Redwater Partnership. The Partnership is an alliance between North West Upgrading and Canadian Natural Upgrading Ltd., a subsidiary of Canadian Natural Resources Ltd. It is the first Canadian refinery built in 30 years.

Sturgeon is estimated to process 13 103m3/d (79 Mb/d) of diluted bitumen into ultra-low sulphur diesel fuel and other high-value products, including diluent.

In its first phase of operation, the Alberta government will provide 75% of the diluted bitumen feedstock and Canadian Natural Resources will supply the remaining 25%.

Source: North West Redwater Partnership

The refinery produced its first diesel fuel in December 2017. It is still under construction and can currently only process synthetic crude oil and not bitumen.

Sturgeon is using advanced technologies to reduce environmental impacts, including a carbon capture and storage (CCS) system. The refinery will also tie into the Alberta Carbon Trunk Line that will transport CO2 to declining oil fields in central Alberta for the purpose of enhanced oil recovery.

- Date modified: