ARCHIVED - Industrial Energy Use in Canada: Emerging Trends - Energy Brief

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Industrial Energy Use in Canada: Emerging Trends - Energy Brief [PDF 168 KB]

November 2010

Industrial Energy Use in Canada: Emerging Trends - Energy Brief

The resource and manufacturing industries are central to Canada's economic well-being. In addition to a large manufacturing base, Canada has the second largest oil reserves in the world and is a leading producer and exporter of natural gas, forest products, pulp and paper, potash, copper, nickel, aluminum, coal, zinc, diamonds, gold, iron, steel, and uranium.

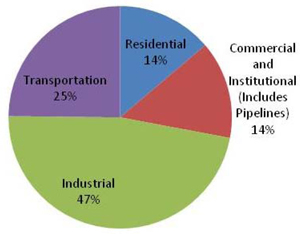

At the same time, the industrial sector accounts for almost half of total energy use in Canada (Figure 1), and is a major contributor to Canada's high energy intensity. In this context, energy intensity refers to units of energy use for each unit ($) of economic output. Since energy use is so closely tied to economic conditions, energy intensity is an important expression of energy use.

Figure 1: Canadian Energy Consumption by Sector 2008

Source: Statistics Canada, 2010

Industrial Energy Use Data and Trends

Industrial energy demand moves in close step with the general state of the economy. Between 2000 and 2007 Canada saw particularly robust economic growth. The Canadian industrial sector benefited from a global ‘commodities boom' caused by surging economies in Asia. The average GDP growth rate from 2000 to 2007 for all industry combined was 2.7 per cent annually.[1]

[1] Statistics Canada. National Economic Accounts, CANSIM Table 327-0027, 2009

Meanwhile, Industrial energy demand grew 23 per cent between 1990 and 2008. However, decreases in energy use in the last two years demonstrate how general economic conditions influence industrial energy use. The economic crisis in 2008 resulted in decreases in energy use after years of steady increases (Figure 2).

Figure 2: Indexing Canadian Energy Use

Source: Statistics Canada, NEB, NRCan, 2010

Structural Change in Canada's Economy

Canada's economy has experienced an ongoing structural change for decades. There has been a slow, steady shift from the resource and manufacturing (“goods”) side of the economy, to the services and knowledge side of the economy.

In terms of economic output, the service sector in Canada is significantly larger than the goods sector, and is growing faster. Between 1990 and 2008, Canada's GDP grew by almost 60 per cent, while energy use in this period grew only 28 per cent.

This is significant in that the service sector uses significantly less energy per unit ($) of economic output. As the share of the service sector increases relative to the goods sector, the energy intensity of the Canadian economy will continue to improve.

Trade is also fundamental to the health of the Canadian economy. Canada's $490 billion in exports accounted for 39 per cent of GDP in 2008, and this share is growing.[2] Energy products account for about one-quarter of trade revenue, and over half of Canada's trade revenue is from manufactured products. Growing demand for Canadian goods, in large part driven by changes in global markets, is having an impact on industrial energy consumption.

[2] Industry Canada. GDP by Sector of the Canadian Economy (NAICS 11-91), Canadian Industry Statistics, 2009.

Industrial Production Processes and Technological Change

Meanwhile, new and more efficient technology is making headway in improving the energy intensity of the industrial sector in Canada.

A recent technical review of the world's major industries by the International Energy Agency suggests industry as a whole has could realize further energy efficiency gains of 18 to 26 per cent.[3] The industrial sector, motivated by factors such as increasing energy costs, on-going education and awareness programs, and regulatory changes, is already working to adopt more efficient technologies.

[3] International Energy Agency. Tracking Industrial Energy Efficiency and CO2 Emissions, 2007.

A move towards more transformative, innovative technologies is expected to see this trend improve even further. This could include fuel switching to renewable fuels, cogeneration, heat recovery, and other clean technologies.

Future Analyses

The industrial sector is expected to remain the largest consumer of energy in Canada for the coming years. However, there are a couple of factors that will influence Canada's energy intensity; or the amount of energy used, for each dollar of economic output. These factors include continuing structural changes in Canada's economy as well as industrial production processes and technological changes.

As the share of the service sector increases relative to the goods sector, the energy intensity of the Canadian economy will continue to improve. Meanwhile, the changing dynamics of international markets, and growing trade associated with energy intensive industries will continue to influence total Canadian energy demand trends. Finally, new and improved technology will help reduce the energy intensity of the industrial sector in Canada.

- Date modified: