ARCHIVED – A Primer for Understanding Canadian Shale Gas – Energy Briefing Note

This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

ISSN 1917-506X

A Primer for Understanding Canadian Shale Gas - Energy Briefing Note [PDF 7850 KB]

Energy Briefing Note

A Primer for Understanding Canadian Shale Gas

November 2009

Copyright/Permission to Reproduce

Table of Contents

- Foreword

- Executive Summary

- Introduction

- What is Shale?

- Petroleum History

- Source of Natural Gas in Shale

- Shales as Reservoirs

- Drilling and Completing Shale Gas Wells

- Well Costs

- Infrastructure and Relevance to Canadian Production

- Descriptions of Prospective Canadian Gas Shales

- Observations

List of Figures

| Figure 1 | Shale Gas Plays of North America |

| Figure 2 | Utica Shale near town of Donnaconna, Quebec |

| Figure 3 | Biogenic (Nursery) and Thermogenic (Kitchen) Methane Generation |

| Figure 4 | Heavily Fractured Utica Shale near fault, Montmorency Falls, Quebec |

| Figure 5 | Horizontal Versus Vertical Wells and Multi-stage Hydraulic Fracturing |

| Figure 6 | Microseismic Imaging of a Multi-stage Frac |

| Figure 7 | Schematic of a multi-well drilling pad and multiple horizontal wells originating from the same wellsite |

| Figure 8 | Historical and Projected Production Profiles for Montney Shale Gas Wells |

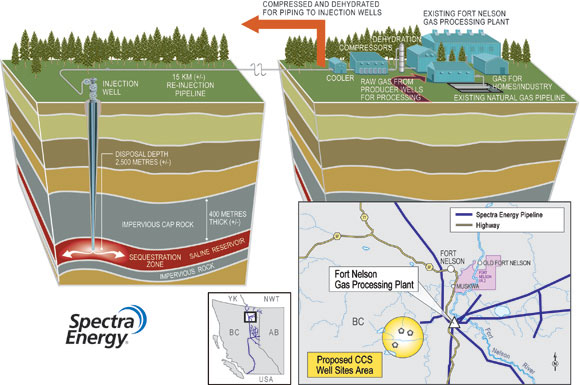

| Figure 9 | Schematic of Spectra Energy's proposed carbon dioxide sequestration facility near Fort Nelson |

| Figure 10 | Montney Formation Gas Production and Play Types in Northwestern Alberta and Northeast British Columbia |

| Figure 11 | Montney Shale Gas Horizontal Well Count and Production to July 2009 |

| Figure 12 | Horn River Basin Stratigraphy and Location |

| Figure 13 | The Utica Shale and Location of Potential Production Trends |

| Figure 14 | Northwest to Southeast Cross-section of the Utica Shale |

List of Tables

| Table 1 | Comparison of Canadian Gas Shales |

Foreword

The National Energy Board (NEB or the Board) is an independent federal agency that regulates several aspects of Canada's energy industry. Its purpose is to promote safety and security, environmental protection and efficient energy infrastructure and markets in the Canadian public interest within the mandate set by Parliament in the regulation of pipelines, energy development and trade. The Board's main responsibilities include regulating the construction and operation of interprovincial and international oil and gas pipelines as well as international and designated interprovincial power lines. The Board regulates pipeline tolls and tariffs for pipelines under its jurisdiction. In terms of specific energy commodities, the Board regulates the exports and imports of natural gas as well as exports of oil, natural gas liquids (NGLs) and electricity. Additionally, the Board regulates oil and gas exploration, development and production in Frontier lands and offshore areas not covered by provincial or federal management agreements. The Board's advisory function requires keeping under review matters over which Parliament has jurisdiction relating to all aspects of energy supply, transmission and disposal of energy in and outside Canada.

The NEB monitors energy markets to objectively analyze energy commodities and inform Canadians about trends, events, and issues. The Board releases numerous research reports. This report is a briefing note - a brief report covering one aspect of energy commodities. Specifically, this report examines the different aspects of shale gas development to aid in the public understanding of this emerging resource.

The NEB would like to thank Ross Smith Energy Group, Ziff Energy Group, Schlumberger, Spectra Energy, and JuneWarren Publishing for permission to use their illustrations. Spectra Energy provided helpful discussion on carbon dioxide (CO2) sequestration in northeast British Columbia.

If a party wishes to rely on material from this report in any regulatory proceeding before the NEB, it may submit the material, just as it may submit any public document. Under these circumstances, the submitting party in effect adopts the material and that party could be required to answer questions pertaining to the material. The Board points out that, while it references specific estimates or projections in this briefing note, the Board is in no way passing judgment on applications currently in front of it or future applications that may come before it.

Executive Summary

In a relatively new development over just the past few years, shale formations are being targeted for natural gas production. Based on initial results, there may be significant potential for shale gas production in various regions of Canada, including traditional areas of conventional production like Alberta, British Columbia, and Saskatchewan, and non-traditional areas like Quebec, Nova Scotia, and New Brunswick. However, there is much uncertainty because most Canadian shale gas production is currently in experimental or early developmental stages. Thus, its full potential will not be known for some time. If exploitation proves to be successful, Canadian shale gas may partially offset projected long-term declines in Canadian conventional natural gas production.

This emerging resource can be considered a technology driven play as achieving gas production out of otherwise unproductive rock requires technology-intensive processes. Maximizing gas recoveries requires far more wells than would be the case in conventional natural gas operations. Furthermore, horizontal wells with horizontal legs up to two kilometres in length are widely used to access the reservoir to the greatest extent possible. Multi-stage hydraulic fracturing, where the shale is cracked under high pressures at several places along the horizontal section of the well, is used to create conduits through which gas can flow. Micro-seismic imaging allows operators to visualize where this fracture growth is occurring in the reservoir. However, as a technology driven play, the rate of development of shale gas may become limited by the availability of required resources, such as fresh water, fracture proppant, or drilling rigs capable of drilling wells several kilometres in length.

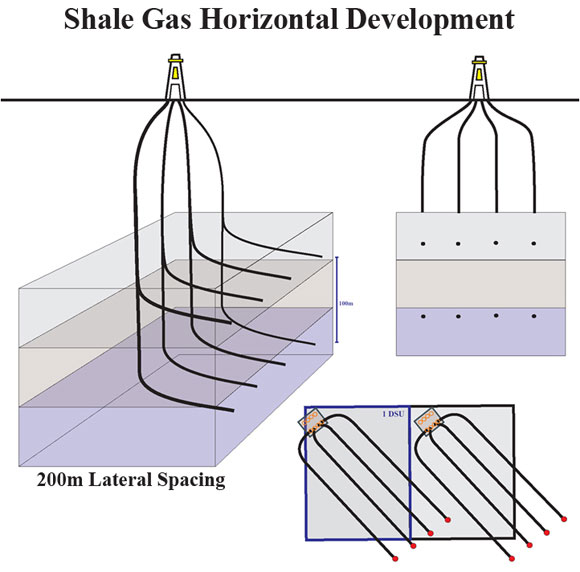

There are some environmental concerns with the specialized techniques used to exploit shale gas. There is potential for a heavy draw on freshwater resources because of the large quantities required for hydraulic fracturing fluid. The land-use footprint of shale gas development is not expected to be much more than the footprint of conventional operations, despite higher well densities, because advances in horizontal drilling technology allow for up to ten or more wells to be drilled and produced from the same wellsite. Finally, there is potential for a high carbon footprint through emissions of carbon dioxide (CO2), a natural impurity in some shale gas. Proposals have been made for carbon capture and storage as a remedy.

Introduction

Canadian production of conventional natural gas is declining and is expected to continue declining over the next few years.[1] In response, industry has been shifting its exploration focus towards unconventional natural gas (i.e. natural gas that can be produced from non-traditional, low permeability[2] reservoirs such as shales or coals). Many also include tight gas within the unconventional category, such as from low permeability sandstones, limestones, or dolostones. Development of these unconventional resources is technologically challenging. The principal Canadian shale gas plays are the Horn River Basin and Montney shales in northeast British Columbia, the Colorado Group of Alberta and Saskatchewan, the Utica Shale of Quebec, and the Horton Bluff Shale of New Brunswick and Nova Scotia.

[1] National Energy Board, 2009. Short-term natural gas deliverability 2009-2011 - Energy Briefing Note

[2] Permeability is the ability of a liquid or gas to move through a porous and/or fractured solid.

Figure 1: Shale Gas Plays of North America

Source:

Advanced Resources, SPE/Holditch Nov 2002 Hill 1991, Cain, 1994 Hart Publishing, 2008

modified from Ziff Energy Group, 2008.

Note:

Developing: Barnett, Fayetteville, Haynesville, Woodford, Marcellus, Montney and Horn River

Evaluating: Barnett/Woodford, Utica, Gothic and Eagle Ford

Other shale plays: potential growth in the medium to long term

What is Shale?

Shale is a sedimentary rock that was once deposited as mud (clay and silt) and is generally a combination of clay, silica (e.g. quartz), carbonate (calcite or dolomite), and organic material.[3] While shales are generally thought of as being clay rich, the proportions of the constituents can be quite variable. Shale may also have thin beds or laminae[4] of sandstone, limestone, or dolostone (Figure 2). The mud was deposited in deep, quiet water such as in large lakes or deep seas and oceans. The organic matter in the mud was algae, plant matter, or plankton that died and sank to the sea floor or lake bed before being buried.

[3] A technical definition of shale can be considered, "A fissile, terrigenous sedimentary rock in which particles are mostly of silt and clay size." Fissile refers to the rock's ability to split into thin sheets along bedding while terrigenous refers to the sediment's origins, that it is the product of weathering of rocks. Blatt, H., and Tracy, R.J., 2000. Petrology: Igneous, Sedimentary, and Metamorphic. W.H. Freeman and Company. New York. 529 p.

[4] A bed is layer of sediment thicker than 1 cm, whereas a lamina (plural: laminae) is a layer of sediment thinner than one centimetre.

Figure 2: Utica Shale near town of Donnaconna, Quebec

Dark beds are shale, light beds are limestone. Part of the dark colour in the Utica Shale comes from organic matter. A writing pen is shown for scale.

Petroleum History

While only attracting significant attention over the past few years, natural gas[5] has been produced from shale formations in the Appalachian Mountains of the United States since the late 1800s. The initial oil discovery at Norman Wells in Canada's Northwest Territories in 1920 flowed oil from fractured shale deposits that were later found to be connected to the underlying conventional oil pool. In southeast Alberta and southwest Saskatchewan, gas has been produced from the Second White Speckled Shale for decades. Another example is the Antrim Shale in the Michigan Basin, which has produced shale gas since the late 1940s. In all of these early cases, there was sufficient natural fracturing of the shale to allow economic recovery typically through shallow vertical wells producing at low rates over a long time.

[5] The term "natural gas" refers to methane and ethane directly produced from geological reservoirs. Before natural gas was collected from wells, methane came from "manufactured gas," which was created during high-temperature processing of coal.

Recent experience shows that, even in areas with less natural fracturing, shale gas can still be turned into a prolific resource. A typical Barnett Shale well from Texas flows 85 000 to 140 000 cubic metres per day (m³/d), or 3 to 5 million cubic feet per day (MMcf/d), on startup. In comparison, the average Canadian conventional natural gas well drilled and put on production in 2007 had initial production of approximately 5 700 m³/d (0.2 MMcf/d).[6] Production from the Barnett Shale as a whole is expected to peak somewhere around 140 106m³/d (5 Bcf/d)[7] in the next few years. In other words, the Barnett Shale is expected to produce the equivalent of almost one-third of Canada's 2008 natural gas production (458 106m³/d; 16.2 Bcf/d) or two-thirds of Canada's 2008 natural gas consumption (216 106m³/d; 7.6 Bcf/d).[8]

[6] National Energy Board, 2008. Short-term Canadian Natural Gas Deliverability 2008-2010 - Energy Market Assessment , Appendices, Figure A2.1.

[7] Abbreviations used for large metric volumes in this report are 106m³ (million cubic metres), 109m³ (billion cubic metres), and 1012m³ (trillion cubic metres). Additional abbreviations used for large imperial volumes in this report are Bcf, which means billion cubic feet, and Tcf, which means trillion cubic feet.

[8] National Energy Board, 2009. Canada Energy Overview 2008.

Source of Natural Gas in Shale

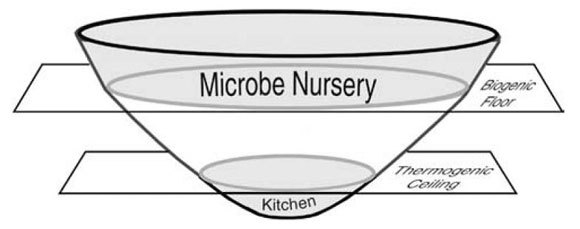

As mud turns into shale during shallow burial, generally just a few hundred metres deep, in the "nursery", bacteria feed on the available organic matter (up to 10 per cent of the rock volume but generally less than five per cent) and release biogenic methane as a byproduct (Figure 3).[9] Natural gas is also generated during deep burial while the shale is in the "kitchen", generally several kilometres deep, where heat and pressure crack the organic matter, including any oil already produced by the same heat and pressure, into smaller hydrocarbons, creating thermogenic methane (Figure 3). Some of the oil and gas manages to escape and migrate into the more porous rock of conventional reservoirs. In fact, the vast bulk of the world's conventional reserves of oil and gas were generated in and escaped from organic-rich shales. But some oil and gas does not escape, as it is either trapped in the micropore spaces or attached to the organic matter within the shale.

[9] Shurr, G.W., and Ridgley, J.R. 2002. Unconventional shallow gas biogenic systems. AAPG Bulletin, v. 86, no. 11. p. 1939-1969.

Figure 3: Biogenic (Nursery) and Thermogenic (Kitchen) Methane Generation

Source: Shurr and Ridgley, 2002.

For example, the natural gas produced from the Second White Specks Shale of Alberta and Saskatchewan comes from shallow burial (it is shallow enough that gas is still being generated by bacteria), while the natural gas from the Devonian Horn River Basin and Triassic Montney shales was generated during deep burial. The Utica Shale of Quebec has both shallow and deep sections and there is potential for both biogenic and thermogenic natural gas, respectively.

The origins of natural gas become important when evaluating shale-gas prospects. For example, thermogenic systems often produce natural gas liquids[10] with the methane, which can add value to production, whereas biogenic systems generate methane only. Thermogenic systems can also lead to the generation of carbon dioxide as an impurity in the natural gas, which costs money to remove and can increase greenhouse-gas emissions. Thermogenic plays tend to flow at high rates, but are normally exploited through the extensive use of horizontal drilling and are therefore more expensive to develop than biogenic plays, which flow at lower rates and are exploited through shallow, closely spaced vertical wells instead.

[10] Natural gas liquids (NGLs) are hydrocarbons heavier than methane, like propane, butane, and pentane, that are commonly associated with natural gas production.

Shales as Reservoirs

In conventional reservoirs, oil and gas are fairly mobile and easily move through the permeable formation because of buoyancy (they are lighter than the water in the same formation and therefore rise) until they are trapped against an impermeable rock (i.e. a seal) that prevents further movement. This leads to localized pools of oil and gas while the rest of the formation is filled with water. The average natural gas pool in Alberta has 169 106m³ (6.0 Bcf) of gas in place spread over an average of 5.3 square kilometres.

However, shale gas, both biogenic and thermogenic, remains where it was first generated and can be found in three forms: 1) free gas in the pore spaces and fractures; 2) adsorbed gas, where the gas is electrically stuck to the organic matter and clay; and 3) a small amount of dissolved gas that is dissolved in the organic matter. Because typical shales are a few dozen to hundreds of metres (even a few kilometres) thick and extend over very wide geographic areas, gas shales are often referred to as resource plays, where natural gas resources are widely distributed over extensive areas rather than concentrated in specific locations. The volume of natural gas contained within a resource play increases as the thickness and areal extent of the deposit grows. Individual gas shales appear to have hundreds to thousands of billion cubic metres (tens to hundreds of Tcf) of gas in place spread over hundreds to thousands of square kilometres. The difficulty lies in extracting even a small fraction of that gas.

The pore spaces in shale, through which the natural gas must move if the gas is to flow into any well, are 1000 times smaller than pores in conventional sandstone reservoirs. The gaps that connect pores (the pore throats) are smaller still, only 20 times larger than a single methane molecule.[11] Therefore, shale has very low permeability. However, fractures, which act like conduits for the movements for natural gas, may naturally exist in the shale and increase its permeability.

[11] Bowker, Kent A. 2007. Development of the Barnett Shale play, Forth Worth Basin. West Texas Geological Society Bulletin, v. 42, no. 6, p. 4-11.

Figure 4: Heavily Fractured Utica Shale near fault, Montmorency Falls, Quebec

There are also hybrid gas shales, where the originally deposited mud was rich in sand or silt, therefore having naturally higher permeability and greater susceptibility to hydraulic fracturing (see below). Examples include the Triassic Montney Formation and the Cretaceous Second White Speckled Shale. The Montney is so rich in silt and sand that it is often referred to as tight gas, as it has been in many NEB publications. However, unlike typical tight-gas plays, the natural gas in the Montney is sourced from its own organic matter, more typical of shale gas. Importantly, there is no universal definition of shale gas that is shared by various regulatory bodies. For simplicity, the Montney will be referred to as shale gas in this briefing note.

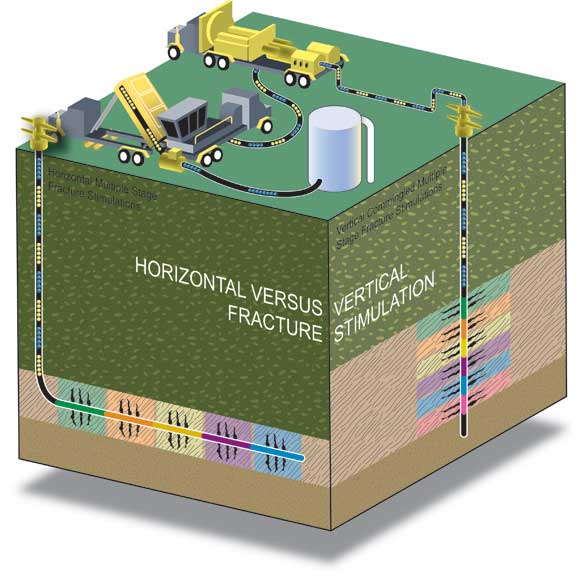

Drilling and Completing Shale Gas Wells

Natural gas will not readily flow to any vertical well drilled through it because of the low permeability of shales. This can be overcome to some extent by drilling horizontal wells, where the drillbit is steered from its downward trajectory to follow a horizontal trajectory for one to two kilometres, thereby exposing the wellbore to as much reservoir as possible (Figure 5). By drilling horizontally, the wellbore may intersect a greater number of naturally existing fractures in the reservoir - the direction of the drill path is chosen based on the known fracture trends in each area. However, some shales can only be drilled with vertical wells because of the risk of the borehole collapsing (e.g. the Cretaceous Second White Speckled Shale of Alberta and Saskatchewan). The trade-off between drilling horizontal versus vertical is increased access to the reservoir, but at a far higher cost.

Figure 5: Horizontal Versus Vertical Wells and Multi-stage Hydraulic Fracturing

Source: JuneWarren Publishing, 2008.

Hydraulic fracturing (commonly referred to as "fraccing", "fracking", or "fracing") is already widely used by the oil and gas industry to improve low permeability reservoirs. Fluid (often water, carbon dioxide, nitrogen gas, or propane) is pumped down the well until the pressure surpasses the rock strength and causes the reservoir to crack (Figure 5). The "frac" fluid pumped down the well is loaded with proppant (often 100 tonnes or more of ceramic beads or sand) that infiltrate the formation and help to prop the fractures open, which are at risk of closing once the pressure is released. The choice of the fluid used in a frac depends on many factors, including whether clay in the reservoir is sensitive to water (some clays swell in the presence of fresh water, such as in the Colorado Shale) or whether the reservoir happens to respond better to particular fluids, usually only determined through experimentation.

Two factors increase the ability of shale to fracture. One is the presence of hard minerals like silica (and to a lesser extent calcite), which break like glass. Clay, however, tends to absorb more of the pressure and often bends under applied hydraulic pressure without breaking. Therefore, silica-rich shales like those found in the Horn River Basin are excellent candidates for fraccing. The other factor is the shale's internal pressure. Overpressured shales develop during the generation of natural gas: because of the low permeability, much of the gas cannot escape and builds in place, increasing the internal pressure of the rock. Therefore, the artificially created fracture network can penetrate further into the formation because the shale is already closer to the breaking point than in normally pressured shales. The Horn River, Montney, and Utica shales are all considered to be overpressured. The Colorado Shale is underpressured.

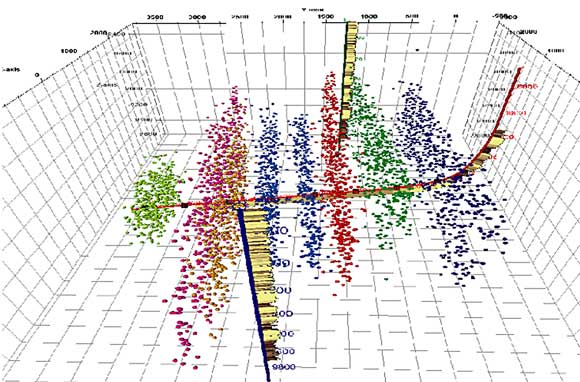

Furthermore, by isolating sections along the horizontal portion of the well, segments of the borehole can be fracced one at a time in a technique called multi-stage fraccing (Figure 5). By listening at the surface and in neighbouring wells, it can be determined how far, how extensively, and in what directions the shale has cracked from the induced pressure (Figure 6). Finally, shales can be re-fracced years later, after production has declined. This may allow the well to access more of the reservoir that may have been missed during the initial hydraulic fracturing or to re-open fractures that may have closed due to the decrease in pressure as the reservoir was drained.

Figure 6: Microseismic Imaging of a Multi-stage Frac

Each color represents a single staged frac.

Source: Schlumberger, 2007.

Even with hydraulic fracturing, wells drilled into low-permeability reservoirs have difficulty "communicating" far into the formation. As a result, additional wells must be drilled to access as much gas as possible, typically three or four, but up to eight, horizontal wells per section[12]. In comparison, only one well per section is typically drilled for conventional natural gas reservoirs in western Canada. However, this does not necessarily mean that there will be a heavier land use footprint versus conventional drilling. Several shale gas wells with horizontal lengths of up to two kilometres can be drilled from a single site one hectare in size, reducing the footprint to one well site or less per section (Figure 7).

[12] A section is based on the Dominion Land Survey (township-range grid system) for dispensing land in western Canada during settlement. One section is equal to one square mile.

Figure 7: Schematic of a multi-well drilling pad and multiple horizontal wells originating from the same wellsite

Note: the upper-right view is cross-sectional whereas the lower-right view is a map view of the estimated well density on single DSUs (drilling spacing units - approximately one square mile).

In conventional reservoirs, as much as 95 per cent of the natural gas can be recovered. For shales, recoveries are expected to be around 20 per cent because of low permeabilities despite high-density horizontal drilling and extensive hydraulic fracturing. However, it appears that some places in the Barnett Shale of Texas may exceed expectations and might achieve 50 per cent rates of recovery.[13] In Canada, total volumes of recoverable gas in each horizontal shale gas well are expected to be from 30 106m³ to 280 106m³ (1 to 10 Bcf), but could grow as improvements in technology increase recoveries. Rates of production from horizontal wells are initially high, generally 85 000 m³/d to 450 000 m³/d (3 to 16 MMcf/d), although they rapidly decline during the first year before setting into a long period of lower rates (Figure 8) at which the well is expected to produce for more than a decade. In vertical shale gas wells, flow rates are much less: silica-rich gas shales have initial production around 28 000 m³/d (1 MMcf/d) while wells in the shallow hybrid Colorado Shale generally produce less than 2 800 m³/d (0.1 MMcf/d). In comparison, the average Canadian conventional natural gas well drilled and put on production in 2007 had initial production rates of approximately 5 700 m³/d (0.2 MMcf/d).[14]

[13] American Association of Petroleum Geologists (AAPG) Explorer, April 2008. Texas 'playgrounds' attract attention.

[14] National Energy Board, 2008. Short-term Canadian Natural Gas Deliverability 2008-2010 - Energy Market Assessment, Appendices, Figure A2.1.

Figure 8: Historical and Projected Production Profiles for Montney Shale Gas Wells

Note: Well production was projected beyond 28 months by logarithmic regression because of the lack of long-term production history of Montney shale gas.

Drilling and hydraulically fracturing wells can be water-intensive procedures; however, there is very limited Canadian experience from which to estimate potential environmental impacts. In the American experience, where water is extensively used in hydraulic fracturing, each well in the Barnett Shale of the Fort Worth Basin in Texas requires an estimated 11 million litres (3 million US gallons) of fresh water. Initial reports from Canadian operators working on Canadian shales indicate some similarities. However, water is not necessarily required for all hydraulic fracturing in gas shales. For example, many fracs in the Montney play use CO2 as the frac fluid. Furthermore, water is not a good candidate for use as a frac fluid for the shallow shales of the Colorado Group of southeastern Alberta and southwestern Saskatchewan because of their sensitivity to water. Operators there appear to be using nitrogen or a mixture of propane and butane as the frac fluid instead. Currently, it is too early to draw conclusions on the impact of shale gas development on the use of fresh water resources in Canada; however, along with the availability of fracture proppant and specialized drilling rigs able to drill wells several kilometres in length, it may be a constraint on the pace of Canadian shale gas development.

Frac water often contains chemical additives to help carry the proppant and may become enriched in salts after being injected into shale formations. Therefore, frac water that is recovered during natural gas production must be either treated or disposed of in a safe manner. Frac water is typically disposed of by injection into deep, highly saline formations through one or more wells drilled specifically for that purpose. The practice is commonplace in western Canada, where wells often produce water in conjunction with conventional oil and natural gas, and is governed by clearly defined regulations. Flow-back water is infrequently reused in other fracs because of the potential for corrosion or scaling, where the dissolved salts may precipitate out of the water and clog parts of the well or the formation. Pilot projects for treatment of flow-back water from the Barnett Shale include distillation, where the distilled water can then be reused in other fracs to reduce requirements for fresh water. Importantly, operators avoid releasing the recovered frac water into the watershed. Furthermore, the fracced reservoir is normally two or more kilometres at depth and the fractures, and frac fluids, cannot extend through such a thick section of rock to reach aquifers at shallow depths where drinking water is extracted. For shallower shales of southeastern Alberta and southwestern Saskatchewan, fracs are of considerably decreased size and the soft nature of the shale will likely prevent extensive penetration of fractures, which may also have a negative impact on ultimate productivity.

Finally, the amount of saline formation water produced from gas shales varies widely, from none to hundreds of barrels per day. The water comes from the gas shale itself or from adjacent formations that are connected through the frac-induced fracture network. The water, like flow-back water, is normally highly saline and must be treated and/or disposed of, typically by injection into deep saline formations.

Well Costs

Shale gas wells can be very expensive because of the cost of horizontal drilling (a function of technology needed to drill horizontal and the extra time required to drill) and technology-heavy hydraulic fracturing techniques that may take several days to fracture a single well. A horizontal well in the Montney Formation will typically cost approximately 5 to 8 million dollars. In the Horn River Basin, a horizontal well costs up to 10 million dollars. Horizontal wells in the Utica Shale are expected to cost 5 to 9 million dollars. Vertical wells targeting biogenic shale gas, like in the Colorado Shale, are far less expensive: the resource is shallow and the wells cost less than $350,000 each.

Infrastructure and Relevance to Canadian Production

At this point in time, major shale gas plays in northeast British Columbia have inadequate local infrastructure to handle production growth beyond the next few years. Spectra Energy currently operates a gas-processing plant at Fort Nelson at the south end of the Horn River Basin capable of processing up to 28 106m³/d (1.0 Bcf/d) of raw gas; however its capacity is currently half full from existing gas production. Spectra is considering adding an additional 7 106m³/d (250 MMcf/d) of capacity by building a facility 40 kilometres northeast of Fort Nelson at Cabin Lake. Furthermore, EnCana Corporation has also proposed building facilities near Cabin Lake to process an additional 68 106m³/d (2.4 Bcf/d) at a cost upwards of $2 billion.[15] In the Montney play area in British Columbia, Spectra Energy has recently had a pipeline approved by the NEB with capacity of 6.2 106m³/d (220 MMcf/d) and is expected to be online in the third quarter of 2009 at a cost of $100 million. In the same area, Nova Gas Transmission Limited has proposed a pipeline with capacity of 28 106m³/d (1 Bcf/d). Importantly, development of shale gas could take several years before significant production is achieved to warrant construction of large-scale, short-haul pipeline capacity. All proposals are subject to regulatory approval.

[15] Globe and Mail, January 9, 2009. BC beckons… and EnCana comes calling.

There is less need to expand major long haul pipeline capacity out of western Canada to move new sources of western Canadian natural gas to American or central Canadian markets. Production of natural gas from western Canada has been declining since mid-2007 and, even just two years ago, was expected to continue to decline in the future.[16] Whether there is potential for western Canadian shale gas to offset these declines was explored in a recent NEB publication[17] where estimates of shale gas production are included in projections of Canadian natural gas supplies to 2020.

[16] National Energy Board, 2007. Canada's Energy Future - Reference Case and Scenarios to 2030.

[17] National Energy Board, 2009. Reference Case Scenario: Canadian Energy Demand and Supply to 2020.

The Utica shale gas play of Quebec is located adjacent to the Trans Québec & Maritimes Pipeline, which has significant room for production additions and serves the Montreal and Quebec City markets as well as connects to pipelines serving the northeastern United States. The Horton Bluff shale gas play in New Brunswick and Nova Scotia is relatively close to the Maritimes & Northeast Pipeline Management's mainline and Halifax Lateral pipelines, respectively, which feed markets in the Maritimes as well as export gas into the northeastern United States.

The impact of shale gas on Canadian pipeline infrastructure is further discussed in a separate NEB publication.[18]

[18] National Energy Board, 2009. Canada's Energy Future: Infrastructure Changes and Challenges to 2020. October, 2009.

Natural Gas Byproducts and CO2 Emissions

Most natural gas production requires processing to remove traces of other hydrocarbons and impurities from the natural gas stream. The recovery of natural gas liquids such as propane, butane, pentanes and other condensate is a value-adding process throughout much of western Canada. Other trace products such as hydrogen sulfide (H2S) and carbon dioxide (CO2) are referred to as acid gas and must be removed from the gas stream to prevent corrosion of pipelines and equipment for safety reasons.

While Horn River Basin shale gas has low levels of natural gas liquids, it contains approximately 12 per cent CO2, which originated when the shale was exposed to very high temperatures during very deep burial in the gas window, converting some of the methane, organic matter, and carbonate minerals into CO2. This is a significant increase over the average two per cent CO2 content for all gas pools in British Columbia and could represent a significant addition to B.C.'s, and Canada's, carbon emissions if the CO2 is vented into the atmosphere. Assuming that the Horn River Basin shales reach production levels of 42 106m³/d (1.5 Bcf/d) by 2015, approximately 3.3 million metric tonnes of CO2 will be produced annually. In comparison, it is equivalent to over half of the annual emissions from all Canadian pulp and paper mills as of 2006 (5.95 million metric tonnes). Total Canadian production of CO2 in 2006 was 721 million metric tonnes.[19]

[19] Environment Canada's Greenhouse Gas Division, 2008. National Inventory Report: Greenhouse Gas Sources and Sinks in Canada, 1990-2006.

The British Columbia government is encouraging a carbon capture and sequestration (CCS) strategy for Horn River Basin CO2. Spectra Energy and EnCana Corporation have proposed building sequestration capabilities into their respective existing or proposed Horn River Basin gas-processing plants that will have the capability to dispose of CO2 into Devonian-aged brine-saturated formations a few thousand metres below the surface (Figure 9). Furthermore, EnCana has also proposed to divert some of the CO2 for use in enhanced oil recovery (EOR) projects in nearby, mature oil pools. While EOR has been successfully used to increase oil recoveries in southern Saskatchewan at the Weyburn oil field while also storing 13 million tonnes of CO2,[20] there are risks, including whether there is the capacity to handle injections at any proposed gas-processing site should offsite EOR injections go offline. In particular, at this very early stage, there are considerable uncertainties of ultimate storage capacity, the rates at which CO2 can be injected, and whether the projects can be made economically feasible. Spectra Energy is planning on drilling two wells in 2009 to test the CCS concept at a cost of $12 million.[21] Should either EnCana's or Spectra's projects go ahead, they would be among the largest sequestration operations in the world by volume of CO2 stored.

[20] Canadian Association of Petroleum Producers..

[21] Globe and Mail, January 22, 2009. A test case for tackling the CO2 challenge.

Figure 9: Schematic of Spectra Energy's proposed carbon dioxide sequestration facility near Fort Nelson

Carbon Capture and Storage

Source: Spectra Energy, 2008.

Other Canadian gas shales, like the Montney, Colorado Group, and Utica, have one per cent or less CO2. CO2 contents in the Horton Bluff Group of Nova Scotia appear to average around five per cent. There has been no public discussion of a sequestration strategy for CO2 emissions from the Horton Bluff Group as it is in such an early stage of evaluation.

Descriptions of Prospective Canadian Gas Shales

Basic qualities of Canadian gas shales currently undergoing evaluation through drilling and flow testing are summarized in Table 1. These numbers come from a variety of third-party sources, including exploration companies that selectively release information as part of their public reporting. The NEB has made no attempt to verify these numbers. The Geological Survey of Canada has done a far more extensive preliminary examination of gas shales, including many not currently being drilled by exploration companies.[22] From Table 1, it appears that there may be potential for 30 1012m³ (1000 Tcf) of gas in place, if not more, remembering that there is great uncertainty in the accuracy of the estimates. How much of that gas can be recovered still needs to be confirmed. Initial estimates are about 20 per cent.

[22] Hamblin, A.P., 2006. The "Shale Gas" concept in Canada: a preliminary inventory of possibilities, Geological Survey of Canada, Open File 5384, 103 p.

Table 1: Comparison of Canadian Gas Shales

| Horn River | Montney | Colorado | Utica | Horton Bluff | |

|---|---|---|---|---|---|

| Depth (m) | 2 500 to 3 000 | 1 700 to 4 000 | 300 | 500 to 3 300 | 1 120 to 2 000+ |

| Thickness (m) | 150 | up to 300 | 17 to 350 | 90 to 300 | 150+ |

| Gas-filled porosity (%) | 3.2 to 6.2 | 1.0 to 6.0 | less than 10 | 2.2 to 3.7 | 2 |

| Total organic content (%) | 0.5 to 6.0 | 1 to 7 | 0.5 to 12 | 0.3 to 2.25 | 10 |

| Maturity (Ro)* | 2.2 to 2.8 | 0.8 to 2.5 | biogenic | 1.1 to 4 | 1.53 to 2.03 |

| Silica (%) | 45 to 65 | 20 to 60 | sand and silt | 5 to 25 | 38 |

| Calcite or dolomite (%) | 0 to 14 | up to 20% | - | 30 to 70 | significant |

| Clay (%) | 20 to 40 | less than 30 | high | 8 to 40 | 42 |

| Free gas (%) | 66 | 64 to 80 | - | 50 to 65 | - |

| Adsorbed gas (%) | 34 | 20 to 36 | - | 35 to 50 | - |

| CO2 (%) | 12 | 1 | - | less than 1 | 5 |

| GIP/section (million m³)** | 1 700 to 9 000+ | 230 to 4 500 | 623 to 1 800 | 710 to 5 950 | 2 000 to 17 000+ |

| GIP/section (Bcf)** | 60 to 318+ | 8 to 160 | 22 to 62 | 25 to 210 | 72.4 to 600+ |

| Play area GIP (billion m³)** | 4 100 to 17 000 | 2 300 to 20 000 | > 2 800 | > 3 400 | > 3 700 |

| Play area GIP (Tcf)** | 144 to 600+ | 80 to 700 | > 100 | > 120 | > 130 |

| Horizontal well cost, including frac (Million $Cdn) | 7 to 10 | 5 to 8 | 0.35 (vertical only) | 5 to 9 | unknown |

| compiled from various sources * Ro (vitrinte reflectance) is a measure of the thermal maturity of organic matter; values above 1.2 are in the gas window **GIP: gas in place; recoverable gas may be on the order of 20 per cent |

|||||

Montney Formation

The Triassic Montney Formation of northeastern British Columbia (Figure 1) spans a wide variety of depositional environments, from shallow-water sands in the east to offshore muds to the west (Figure 10). Natural gas is currently produced from conventional shallow-water shoreface sandstones at the eastern edge of the Montney and from deep-water tight sands at the foot of the ramp. However, hybrid shale gas potential is being realized in two other zones: 1) the Lower Montney, in sandy, silty shales of the offshore transition and offshore-marine parts of the basin; and 2) the Upper Montney, below the shoreface, where silts have buried the tight sands at the foot of the ramp. The Montney is so thick (well over 300 metres in some places) that some operators are planning to pursue stacked horizontal wells, where horizontal legs are drilled at two elevations in the same well, penetrating and fraccing both the Upper and Lower Montney. Total organic carbon in Montney shale is up to seven per cent and the rocks were heated until they were well into the thermogenic gas window.

Figure 10: Montney Formation Gas Production and Play Types in Northwestern Alberta and Northeast British Columbia

Source: modified from Ross Smith Energy Group, 2008.

Estimates of natural gas in the Montney are highly variable, from 2.3 to 20 1012m³ (80 to 700 Tcf) of gas in place.[23] It should be noted that only a fraction of that (approximately 20 per cent) is likely to be recovered. Furthermore, the Montney estimates do not include the overlying Doig Phosphate, which is also considered prospective for shale gas. To put this estimate into perspective, the North Slope of Alaska has 1.0 1012m³ (35 Tcf) of discovered recoverable natural gas resources with a high-case estimate of 3.9 1012m³ (137 Tcf) ultimately recoverable resources when potential future discoveries are estimated.[24]

[23] British Columbia Ministry of Energy, Mines, and Petroleum Resources. 2006. Regional "Shale Gas" Potential of the Triassic Doig and Montney Formations, Northeastern British Columbia. Petroleum Geology Open File 2006-02.

[24] US Department of Energy, 2008. DOE Report: Alaska North Slope has plenty of potential.

To obtain Montney gas rights from British Columbia, exploration companies spent over $1.3 billion in 2008 and $2.4 billion overall since 2005 at government auctions.[25]

[25] British Columbia Ministry of Energy, Mines, and Petroleum Resources. 2008. Montney Activity/Production NE British Columbia.

Since 2005, production of natural gas from horizontal shale gas wells drilled in the Montney has risen from zero to 10.7 106m³/d (376 MMcf/d) and is expected to continue rising (Figure 11). As of July 2009, 234 horizontal wells were producing from Montney shale, dominantly from the Heritage pool of British Columbia. Individual wells generally produce 85 000 to 141 000 m³/d (3 to 5 MMcf/d) on startup, but can produce over 280 000 m³/d (10 MMcf/d), followed by rapid declines to long lived lower production rates (Figure 8). These wells normally have seven to nine, but up to twelve, 100-tonne CO2 or water fracs staged over horizontal legs of two kilometres in length.

Figure 11: Montney Shale Gas Horizontal Well Count and Production to July 2009

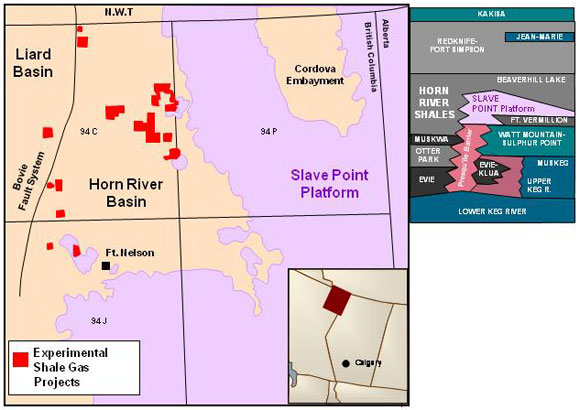

Horn River Basin / Cordova Embayment

Devonian Horn River Basin shales were deposited in deep waters at the foot of the Slave Point carbonate platform in northeast B.C. (Figure 12), which has been producing conventional natural gas for many decades. Horn River Basin shales are silica-rich (around 55 per cent) and approximately 150 metres thick. Total organic content is one to six per cent. The rocks are very mature, having been heated far into the thermogenic gas window.[26],[27] A commonly used estimate for gas in place for the Horn River Basin is 14 1012m³ (500 Tcf)[28],[29], of which about 20 per cent is expected to be recoverable.

[26] British Columbia Ministry of Energy, Mines, and Petroleum Resources. 2005. Gas Shale Potential of Devonian Strata, Northeastern British Columbia. Petroleum Geology Special Paper 2005-01.

[27] Ross, D.K., and Bustin, R.M. 2008. Characterizing the shale gas resource potential of Devonian-Mississippian strata in the Western Canada sedimentary basin: Application of an integrated formation evaluation. AAPG Bulletin, v. 92, p 87125.

[28] Ibid.

[29] British Columbia Ministry of Energy, Mines, and Petroleum Resources. 2007. Shale Gas Potential: Core and Cuttings Analysis, Northeast British Columbia. Petroleum Geology Open File 2007-01.

Figure 12: Horn River Basin Stratigraphy and Location

Source: Ziff Energy Group, 2008.

Testing is still in the preliminary stage, with about twenty horizontal wells drilled, hydraulically fractured, and flowing into pipelines. Horn River Basin wells are very prolific and produce up to 450 000 m³/d (16 MMcf/d) on startup according to several different reports, remembering that production declines in shale-gas wells are steep and within just a few months, production should be significantly less. Regardless, top Horn River Basin shale gas wells will likely rank amongst the most productive natural gas wells drilled in western Canada in 2009. Currently, production data from the Horn River Basin is still confidential and estimating total shale-gas production is not possible.

EnCana Corporation, who will be one of the major producers of shale gas in the Horn River Basin, and Spectra Energy, one of the major pipeline operators in northeast B.C., have both proposed gas-processing plants to be located near Fort Nelson, B.C.. EnCana's facility would be completed in six stages with each stage added as new production comes online. The first stage is reported to cost $400 million and is expected to enter service in 2011 with the capacity to process 11 106m³/d (400 MMcf/d) of natural gas. The ultimate cost of the project could reach $2 billion for all six stages and would be capable of processing 68 106m³/d (2.4 Bcf/d).

The Cordova Embayment is associated with the Horn River Basin (Figure 12) and also has shale gas potential, although it is at a much earlier stage in its evaluation by industry. The Cordova Embayment is estimated to have 5.7 1012m³ (200 Tcf) gas in place. As of May 2009, exploration companies have spent over $2 billion at government auctions to acquire resource rights in the Horn River Basin from the British Columbia government, while activity has been far less in the Cordova Embayment, with less than $40 million spent.[30] It should be noted that the Horn River Basin shale gas play extends into both the Yukon Territory and the Northwest Territories, although its northward extent beyond provincial/territorial borders is poorly defined.

[30] British Columbia Ministry of Energy, Mines, and Petroleum Resources. 2008. Landsales in the Horn River Basin, Liard Basin, & Cordova Embayment, NE British Columbia.

Colorado Group

The Colorado Group consists of various shaley horizons deposited throughout southern Alberta and Saskatchewan (Figure 1) during globally high sea levels of the middle Cretaceous, including the Medicine Hat and Milk River shaley sandstones, which have been producing natural gas for over 100 years, and the Second White Speckled Shale, which has been producing natural gas for decades. In the Wildmere area of Alberta, the Colorado Shale is approximately 200 metres thick, from which natural gas has potential to produce from five intervals. Unlike shales from the Horn River Basin and the Utica Group of Quebec (see below), shale from the Colorado Group produces through thin sand beds and laminae, making it a hybrid gas shale like the Montney. Furthermore, the gas produced in the Colorado has biogenic rather than thermogenic origins. This would suggest very low potential for natural gas liquids and an underpressured reservoir, which is more difficult to hydraulically fracture. Colorado Group shales are sensitive to water, which makes them sensitive to fluids used during hydraulic fracturing. As alternatives, operators are pursuing the use of nitrogen or mixtures of propane and butane as frac fluid.

Only vertical wells are planned for the Colorado Shale because of poor rock conditions and the risk of caving in the wellbore. Currently, more than 85 000 m³/d (3 MMcf/d) is being produced out of a few dozen shallow wells in the Wildmere area of Alberta, each costing approximately $350,000 full cycle from drilling to connection of the well to pipelines.[31] The total volume of gas in the Colorado Group is very difficult to estimate given the wide lateral extent of the shale and variability of the reservoir and the absence of independent and publicly available analyses. However, there could be at least several trillion cubic metres (one hundred Tcf) of gas in place.

[31] Stealth Resources, 2008. Corporate Presentation.

Utica Group

The Upper Ordovician Utica Shale is located between Montreal and Quebec City (Figure 13) and was deposited in deep waters at the foot of the Trenton carbonate platform. Later, the shale was caught up in early Appalachian Mountain growth and became faulted and folded on its southeastern side (Figure 14). The Utica is approximately 150 metres thick and has total organic contents of one to three per cent and has been known for decades as a petroleum source rock for associated conventional reservoirs. However, unlike other Canadian gas shales, the Utica has higher concentrations of calcite, which occur at the expense of some silica.[32] While calcite is still brittle, hydraulic fractures do not transmit as well through it.

[32] Thériault, R. 2008. Caractérisation géochimique et minéralogique et évaluation du potentiel gazéifère des shales de l'Utica et du Lorraine, Basses-Terres du Saint-Laurent. Québec Exploration 2008. Québec, Québec. November, 2008.

Figure 13: The Utica Shale and Location of Potential Production Trends

Source: modified from illustration provided by Ziff Energy Group, 2008.

Figure 14: Northwest to Southeast Cross-section of the Utica Shale

Source: Ziff Energy Group with modifications from Talisman Energy, 2008.

Biogenic gas can be found in the Utica in shallow areas, while thermogenic methane can be found in medium-deep and structured shales (Figures 13 and 14). The reservoir has an advantage over others in that it is folded and faulted, which increases the potential for the presence of natural fractures (Figure 4).

Only a handful of wells have been drilled in the Utica, most of them vertical. After fraccing, each vertical well is reported to have produced approximately 28 000 m³/d (1 MMcf/d) of natural gas. Initial results from hydraulic fracturing and flow tests from three horizontal wells have yielded stable flow rates of 2 800 to 22 700 m³/d (0.1 to 0.8 MMcf/d) from medium-deep shales, less than expected but likely influenced by the lack of equipment to extract frac-water that flowed back during production.[33]

[33] Daily Oil Bulletin, February 24, 2009. Utica Shale horizontals yield less than expected flows.

Of note, the overlying Lorraine Shale may also be prospective; however, it is more clay rich and successful hydraulic fracturing may pose a challenge to production. Very recently, a small explorer active in the St. Lawrence Lowlands estimated that there was likely 3.4 1012m³ (120 Tcf) of gas in place in the Utica Shale in their limited property.[34] Otherwise, there are no reliable, independent analyses of total gas in place for the Utica Shale, let alone the Lorraine Shale.

[34] Questerre Energy, 2009. News release 2009-09-01.

Horton Bluff Group

Lacustrine muds of the Horton Bluff Group of the Canadian Maritimes (Figure 1) were deposited in the Early Mississippian (about 360 million years ago) during regional subsidence. The silica content in the Frederick Brook Shale of the Horton Bluff Group in New Brunswick averages 38 per cent; however, the clay content is also high, averaging 42 per cent.[35] Early reports indicate that organic contents of the Frederick Brook member in Nova Scotia are significantly higher than other Canadian gas shales, at 10 per cent, and the pay zone appears to be over 150 metres thick, sometimes exceeding 1 km in New Brunswick.[36] Flow testing is underway and, while hydraulic fracturing has been less successful than in western Canada, two vertical Frederick Brook wells from New Brunswick have flowed 4 200 m³/d (0.15 MMcf/d) after undergoing small fracs.

[35] Worldwide Geochemistry, 2008. Review of Data from the Elmworth Energy Corp. Kennetcook #1 and #2 Wells Windsor Basin, Canada. 19p.

[36] Corridor Resources, 2009. Corridor reports results of independent shale gas resource study.

An independent analysis indicates that 1.9 1012m³ (67 Tcf) of free gas in place is present in the Frederick Brook shale of the Sussex/Elgin sub-basins of southern New Brunswick.[37] Another independent analysis indicates that 2.0 1012m³ (69 Tcf) of gas in place is present on the Windsor land block in Nova Scotia.[38] Importantly, samples from Nova Scotia indicate that most of the gas is adsorbed onto clay and organic matter[39],[40] and it will take very effective reservoir stimulation to achieve significant production from Nova Scotia shales. It is unclear at this time at what proportion of gas is adsorbed onto clay and organic matter in the New Brunswick shales.

[37] Corridor Resources, 2009. Corridor reports results of independent shale gas resource study.

[38] Ryder Scott Company. 2008. Resource Potential, Horton Bluff Formation, Windsor Basin, Nova Scotia, Canada. 43 p.

[39] Ibid.

[40] Worldwide Geochemistry, 2008. Review of Data from the Elmworth Energy Corp. Kennetcook #1 and #2 Wells Windsor Basin, Canada. 19p.

Observations

It appears that there is potential for 30 1012m³ (1000 Tcf) of shale gas in place within Canada if not more (Table 1). Assuming a 20 per cent rate of recovery, there would be enough recoverable gas to comprise more than one-third of Canada's estimated ultimate potential for all conventional natural gas resources or almost two thirds of currently remaining ultimate conventional resources.[41] High uncertainty, because gas shales are still in the initial stages of evaluation across Canada, precludes calculating more rigorous resource estimates for Canada at the current time. Furthermore, the relative economics of shale gas development also has significant uncertainty. The resource will only be developed if it is profitable, which means the price of gas derived from other sources, like conventional gas, frontier natural gas, and liquefied natural gas (LNG), [42] will need to be higher than the full cycle production cost of shale gas. Currently, only the Montney and Horn River Basin gas shales can be said to have "proof of concept" through numerous production tests after horizontal drilling and hydraulic fracturing and only the Montney currently has what can be called significant amounts of production. The Utica Shale has only had limited production from three hydraulically fractured horizontal wells, making it too early to declare "proof of concept". Production of gas from shallow, vertical wells drilled in Colorado Group shales appears to be limited to the Wildmere area of Alberta to this point. The Horton Bluff Group shales of the Canadian Maritimes are very much in the early evaluation and testing stage.

[41] National Energy Board and Saskatchewan Ministry of Energy and Resources, 2008. Saskatchewan's Ultimate Potential for Natural Gas. Miscellaneous Report 2008-8. Tables 2.6A and 2.6B.

[42] National Energy Board, 2009. Liquefied Natural Gas: A Canadian Perspective - Energy Market Assessment.

Shale gas may be a key component of supply that will allow Canada to sustain its own domestic requirements for natural gas far into the 21st Century. Other sources of this natural gas may include other resource plays (including coalbed methane, tight sandstones and tight carbonates) or future production from Canada's frontier areas in the offshore and in the north. It is even possible that shale gas could allow Canada to become a net exporter of LNG: recently, Apache Corporation and EOG Resources, both active in the Horn River Basin, signed memorandums of understanding to supply natural gas to a proposed LNG liquefaction terminal in British Columbia.[43],[44] However, ultimately, the pace of development of Canadian shale gas may be constrained by the availability of required resources, such as fresh water, fracture proppant, or drilling rigs capable of drilling wells several kilometres in length.

[43] Kitimat LNG, 2009. Kitimat LNG signs MOU with EOG Resources Canada for natural gas supply.

[44] Kitimat LNG, 2009. Kitimat LNG signs MOU with Apache Corporation.

Finally, there are some environmental concerns with development of shale gas in Canada. Little is known about what the ultimate impact on freshwater resources will be. The land-use footprint does not appear to be of significant concern beyond conventional operations, despite higher well densities, because advances in drilling technology allow for ten or more horizontal wells to be drilled from the same wellsite. Furthermore, potential growth in CO2 emissions from shale gas is being addressed with proposals for carbon capture and sequestration. Still, it is very early to come to any conclusions about how development of this potentially large resource will impact the environment.

Ongoing development of this emerging resource is likely to provide additional public data that will enable improved estimates of the contribution of shale gas to Canadian natural gas supply. Thus, the NEB will continue to monitor its progress.

- Date modified: